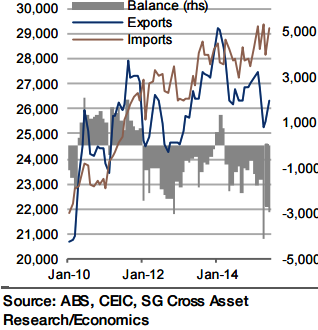

According to the official advanced estimate, imports were practically unchanged in July from June (0.2% mom), meaning that they remained at a high level, and were up by around 4.5% yoy. That said, all of this gain, and more, can be explained by the exchange rate, which in trade-weighted terms was down 13.5% yoy in July.

The volume of imports was estimated about flat over the past year, with the difference explained by weakness in commodity prices, specifically oil, of which Australia is a net importer. Exports, meanwhile, are expected to have continued their recovery after the 8.1% decline they suffered in March/April, but faced a serious headwind in July as the price of iron ore plummeted 17% from June (Port of Qingdao).

"Still, China's July figures for imports from Australia jumped to -4.5% yoy from - 26.5% in June, a move that can only partly be explained by a base effect. Overall, a muted 0.5% increase is expected in exports. As a consequence, the trade deficit should only improve fractionally", says Societe Generale.

Australia's robust imports and weak export prices keep trade deficit elevated

Monday, August 31, 2015 6:09 AM UTC

Editor's Picks

- Market Data

Most Popular

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX