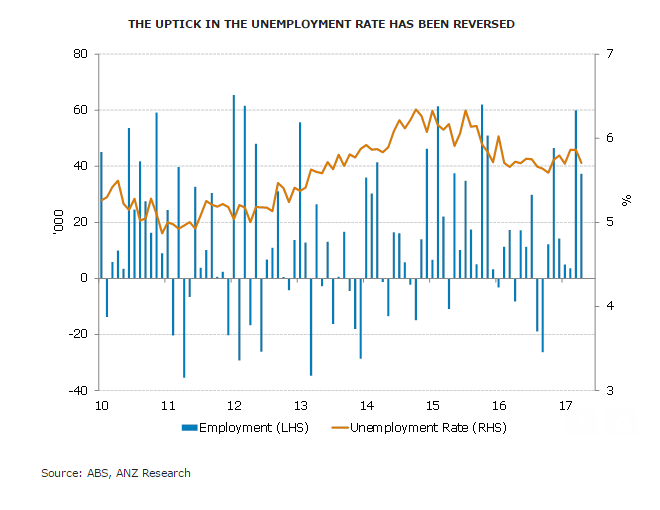

Australia's labour market data released on Thursday showed that employment was up strongly in April, following on from the very strong result for March. Data showed that employment rose 37.4k in April, following the 60k gain in March. However, the headline figure was a little less favourable, with full-time jobs declining by 11.6k after a 75k jump in the previous month.

Thursday's employment data showed all of the gains in jobs in April came from part-time employment which soared 49,000. Total hours worked slipped 0.3 percent. Over the past year, the increase in part-time jobs at 111,300 has outpaced the rise in full-time employment of 80,700. That is one reason wages are growing at a record low rate, undermining domestic consumption.

"We think the strength in Australia's labour market could continue for a while yet, hopefully stemming the trend decline in consumer confidence seen since the start of the year," said ANZ in a report.

Encouragingly the unemployment rate dropped back to 5.7 percent in April, after it rose to 5.9 percent in February and remained at that level despite the strong employment gain in March. The participation rate - the proportion of people in work or actively looking for it - remained steady at 64.8 percent. Paul Dales from Capital Economics said that "the labour market has come to life even though economic growth appears to have slowed a bit."

The Reserve Bank of Australia (RBA) held interest rates at a record low 1.50 percent for a ninth straight month in May. The central bank remains wary about spurring a debt binge in Australia's red-hot property market if it lowered interest rates deeper into record territory. However, the central bank has repeatedly expressed worries about a "mixed" labour market.

"These figures further reduce any lingering chances of more rate cuts," adds Paul Dales, chief economist at Capital Economics.

AUD/USD is extending gains on the day as Aussie remains buoyed by robust jobs data. The pair has broken above 0.7428 which is 23.6% Fib retrace of 0.7749 to 0.7328 fall. Grind higher along 5-DMA continues as the major extends upside in continuation of a 'Bullish Bat Pattern' formation. Major trendline resistance is seen at 0.7475, break above to see further upside.

FxWirePro's Hourly AUD Spot Index was at 62.5812 (Neutral), while Hourly USD Spot Index was at -61.3991 (Neutral) at 1200 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility