Australia’s housing finance approvals fell in December, with both owner-occupier and investor lending down in the month. Some softening in housing finance is consistent with the broad cooling in the housing market seen in late December.

The value of housing finance commitments retraced the previous two months’ gains, falling 2.5 percent m/m in December. Total finance is now 2.2 percent lower than a year ago, the first negative annual growth rate since August 2016. In trend terms, though, housing finance is down just 0.5percent y/y.

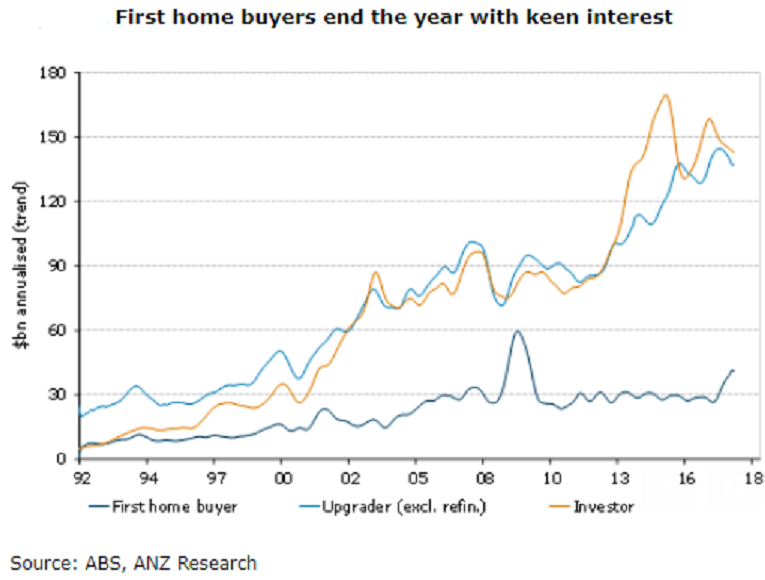

Both owner-occupier and investor lending fell in the month. The value of housing finance for investors fell 2.6 percent m/m in December, to be 10.5 percent lower over the year. In three month end annualized terms, however, the worst now appears behind us in terms of the slowdown in investor finance.

Owner occupier finance also fell, down 2.3 percent m/m in December, but this followed a strong 1.7% bounce the previous month, with approvals still up 5.6 percent y/y.

Finance for first home buyers slipped a touch in December (-1.4 percent m/m) but has stabilized at much higher levels than seen in recent years. Indeed, finance for first home buyers is still up 35 percent y/y and accounted for 11.7 percent of total finance.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock