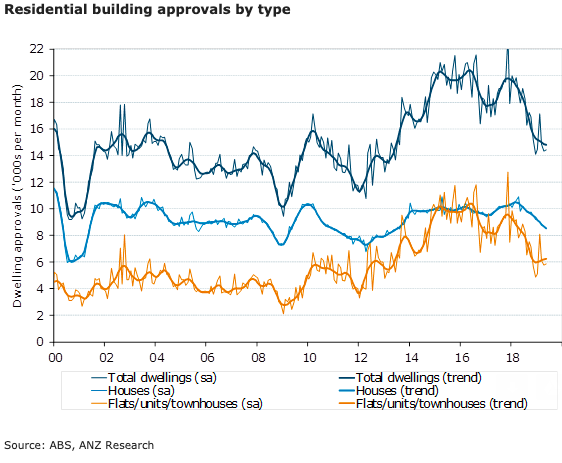

Australia’s building approvals grew modestly during the month of May, albeit remaining well below its highs. However, the easier financial regulations by the APRA and historically low cash rate will further lend support to these approvals, according to the latest report from ANZ Research.

The country’s residential building approvals grew tad 0.7 percent m/m in May, a slight reversal after the sharp declines in March and April (13.4 percent and 3.4 percent m/m respectively). Private sector unit approvals were up 1.2 percent m/m, to be down 20.1 percent y/y.

Private sector house approvals were down 0.3 percent m/m and are now down 12.7 percent y/y. More broadly, a slight pick-up in unit approvals are providing some offset to weaker house approvals.

The month of May highlighted strength in Victoria, where total approvals were up 14.4 percent m/m, driven by an impressive 40.9 percent m/m growth in the volatile unit component. Total NSW approvals were flat, representing a modest tick-up in house approvals, offset by unit weakness.

QLD and SA both saw declines in approvals (-6.3 percent m/m and 2.9 percent m/m respectively), driven by declines in unit approvals; while WA saw a total decline of 4.7 percent driven by weakness in house approvals.

NSW is leading the way on approvals, particularly in units, which have shown a sharp recovery in recent months. Meanwhile, non-residential approvals fell in May although in trend terms they look to be stabilising both in public and private terms, the report added.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility