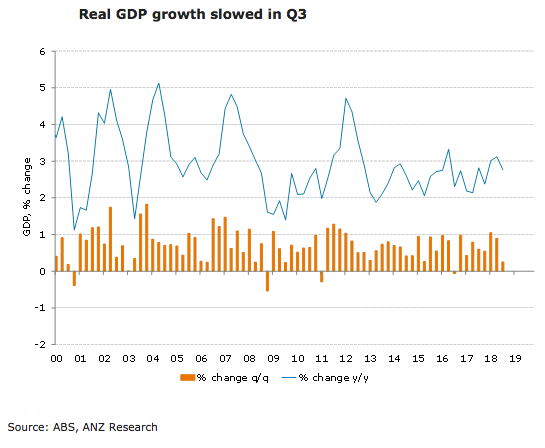

Australia’s gross domestic product for the third quarter of this year rose lower than market expectations, also down from the previous reading in the second quarter of this year. While public spending and net exports were strong contributors to growth, housing construction only eked out a small gain and consumption growth slowed significantly.

Underlining the softness in consumption was further weakness in wages growth. Persistently low wages growth raises the risk that household income growth will not pick up enough to offset the ongoing decline in house prices and support growth in consumer spending.

"In the near term, however, overall GDP growth is likely to hold up given the solid pipeline of public spending, business investment and exports," ANZ Research commented in its latest report.

GDP was up a modest 0.3 percent q/q in Q3, following a rise of 0.9 percent in Q2. Annual growth edged down to 2.8 percent from a downwardly revised 3.1 percent (previously 3.4 percent). The result is likely to be weaker than the RBA expected, with a step up to 1.2 percent q/q in Q4 required to achieve the forecast of 3-1/2 percent by end year published in the November Statement on Monetary Policy.

There were a few downside surprises in the release. In particular, business investment was weaker than was expected, with a sharp fall in mining investment (-7.5 percent q/q) – much weaker than the 2.7 percent decline reported in the capex survey – driving the fall.

Small business profits (-1.3 percent) were also weaker than the Business Indicators Release suggested, likely driven down by falling farm incomes. Household consumption growth (+0.3 percent q/q) was also lower than our forecasts, while wages growth was another area of disappointment.

The persistent weakness in wages growth is surprising. The GDP measure of non-farm average wages rose just 0.2 percent q/q following a 0.1 percent rise in Q1. Annual growth is now at just 1.2 percent, and slowing. Once again, this is a disappointing outcome, and suggests that the tighter labour market is putting very little pressure on labour costs.

"With house price weakness intensifying, wages slow to pick up and consumption softening, the outlook may not be so rosy. This suggests that it will still be some time before inflationary pressures lift, keeping the RBA on hold until well into 2020," the report further commented.

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns