Australia’s weaker-than-expected company profits for the first quarter of this year are likely to pose downside risks to the country’s gross domestic product (GDP), due on Wednesday, projected at 0.6 percent q/q by ANZ Research.

Company profits posted a modest headline rise (+1.7 percent q/q) in Q1, following an upwardly revised rise of 2.8 percent in Q4 (initially reported as +0.8 percent). After adjusting for inventory valuations, the result was a little better, with non-financial profits on a GDP basis rising 2.8 percent q/q.

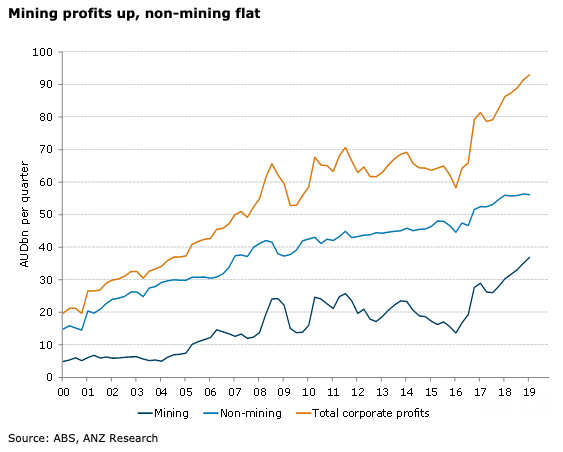

Once again, profit growth was held up by the resources sector, with mining profits up a solid 5.2 percent q/q and 22 percent y/y. Non-mining profits actually fell in Q1 (-0.4 percent q/q), and are now up only 0.3 percent over the past year.

Across the non-mining sectors, weakness was most apparent in arts & recreation (-15 percent q/q), rental, hiring & real estate (-10 percent) and construction (-7 percent). Profits rose solidly in administrative & support services (+14 percent), finance (+8 percent) and information media (+5 percent).

Overall, the profit results are a disappointment, and difficult to reconcile with upbeat investment plans in the Q1 capex survey last week. And small business profits posted a large 3.7 percent drop.

Growth in the wages bill was solid at +1.1 percent q/q, with the Q4 result revised up a touch to +0.9 percent (from an initially reported +0.8 percent). With the increase in this measure of wages driven largely by gains in employment, the GDP measure of average wages is likely to rise only modestly.

Inventories were surprisingly strong (+0.7 percent q/q). While this is a positive for Q1 GDP, (adding 0.2ppt), rising inventories and disappointing sales are not a good combination for the outlook, ANZ Research added in the report.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk