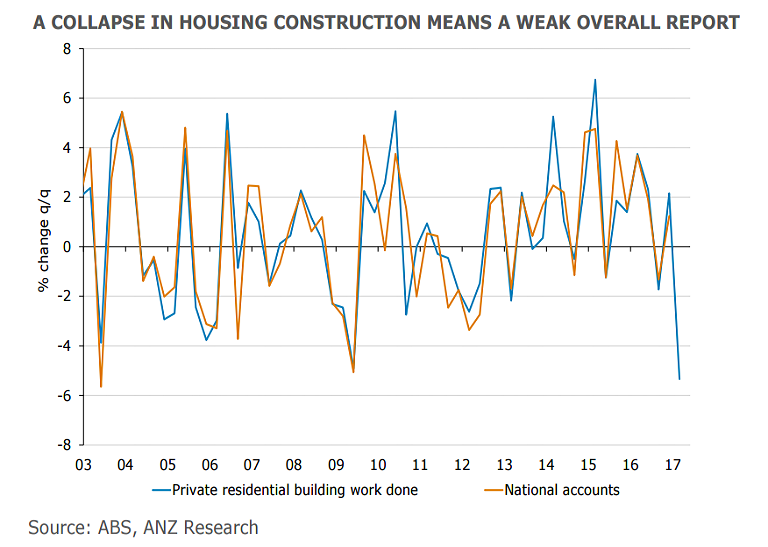

Data released by the Australian Bureau of Statistics on Wednesday showed that total value of construction in Australia, including residential building and engineering work, during the first quarter of this year fell by 0.7 percent from the fourth quarter of 2016. Construction activity came in weaker than expected in Q1, driven entirely by housing construction.

Housing construction was seen as the biggest drag, down 4.7 percent in the quarter, as developers put the brakes on residential projects, likely due to concerns of oversupply. Nevertheless, there was a stronger-than-expected rise of 2.2 percent in engineering construction in the March quarter, the first increase for seven quarters. This is supported by further (albeit mild) growth in non-residential building.

Australia's housing construction boom is starting to peak, and analysts expect it to decline in the coming year. That said, downturn in mining investment is expected to bottom out in coming quarters, removing a stiff headwinds to growth in the economy.

Construction is a building block of GDP data which will be released next week. The Q1 construction result which is clearly weak, dented by the drop in housing, suggests drag on first quarter GDP. A slowdown in consumer demand, the impact of cyclone Debbie and a slowdown in home building activity, especially apartments, have some economists worried that the economy might have slowed sharply in Q1.

"The topping out of apartment construction is an important element of the outlook for growth and interest rates as it has been a key driver of employment growth in the economy to date. Along with soft partial data to date, there is a real risk that Q1 GDP could print a flat or even a small negative outcome." said Tapas Strickland, at National Australia Bank.

AUD/USD was trading largely unchanged on the day at 0.7475 at around 1130 GMT. Back-to-back Doji formations on daily charts suggests recovery from the low of 0.7328 may have topped out. A decisive break below 20-DMA at 0.7432 could see resumption of downside. 100-DMA at 0.7552 is strong resistance on the upside and further gains likely only on break above.

FxWirePro's Hourly AUD Spot Index was at 65.844 (Slightly bullish), while Hourly USD Spot Index was at -16.2685 (Neutral) at 1130 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand