Australian wage price index (WPI) for Q1 came in a touch softer than expected, data released earlier on Wednesday showed. The wage price index rose 0.5 percent quarter-on-quarter in the first quarter, narrowly missing the estimated rise of 0.6 percent. Meanwhile, the annualized figure printed as expected at 2.1 percent.

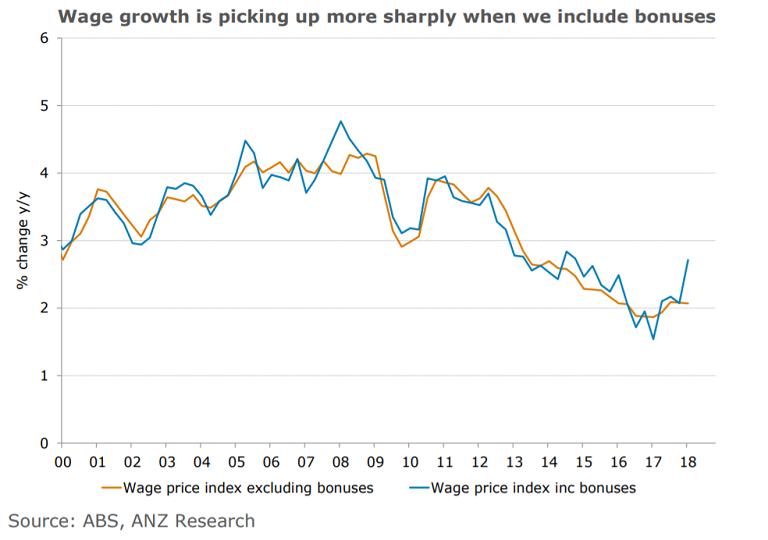

The WPI is a measure of changes in ordinary hourly rates of pay and excludes hours worked, bonuses, superannuation and penalty payments. Firms are paying higher bonuses, and growth in the WPI including bonuses has accelerated sharply recently, to 2.7% y/y, suggesting businesses are paying a higher wage bill but are reluctant to locking in higher costs indefinitely.

"Looking ahead, we expect to see a further gradual improvement in wage growth through 2018. There should be further upside in Q2, but competitive pressures will continue to weigh on firms willingness to raise wages," said ANZ in a report.

Today's data puts into doubt assumptions behind last week's federal budget, which was built on wage growth averaging 2.75 percent over 2018/19. The success of the federal budget rests with the assumption that wage growth will rise sharply in the next couple of years, but there is little evidence that wage growth has improved.

"The weakness in the wage data is particularly striking given the strength of labour demand over the past year," said JP Morgan economist Tom Kennedy.

"We may not see a material improvement in wage growth until the unemployment rate dips below 5 per cent and unfortunately policymakers don't expect that to happen in the next three years," said Asia-Pacific economist Callam Pickering.

The Reserve Bank has noted that it was difficult to see inflation moving into the middle of its 2-3 percent target band if wages continue to grow at just 2 percent. Inflation expectations have been stuck around 2 percent in recent years, below the central bank’s desired average for inflation of 2.5 percent.

AUD/USD trades 0.14% higher on the day at around 0.7482 levels. The major has been on a downward spiral from 2018 highs of 0.8135. Technical studies support further downside in he pair. Price is hovering around major trendline support at 0.7470. Any decisive break below will see resumption of weakness. Next major bear target lies at 61.8% Fib retracement at 0.7327.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election