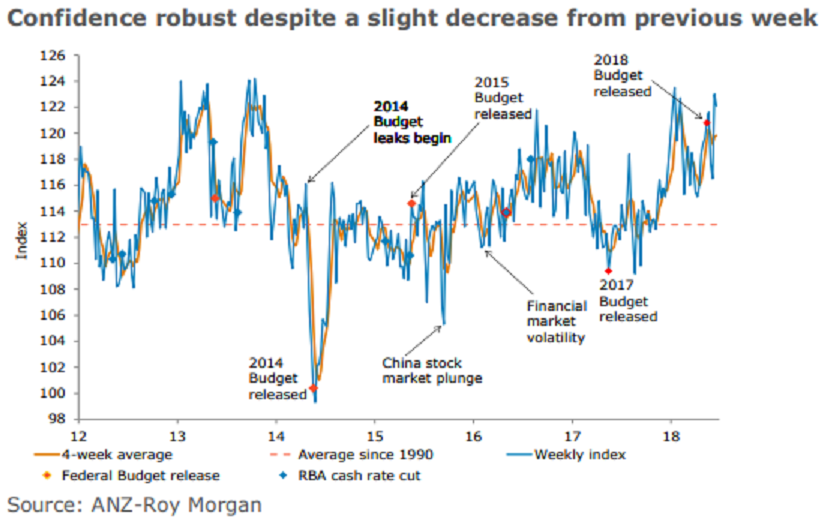

Australia’s ANZ-Roy Morgan consumer confidence weakened slightly by -0.7 percent over the week to 122.1, a solid performance following the large 5.6 percent jump the previous week and leaving the index comfortably above its long term average. The details were mixed, with two out of the five sub-indices posting positive readings.

Expectations about future financial conditions rose 3.1 percent, building on the 1.6 percent gain seen over the week before. The index is now at its highest since January 2017. Views towards current financial conditions, however, fell 4.9 percent over the week, but remained above the long term average.

Consumers’ views towards economic conditions deteriorated. The future economic conditions index fell slightly (-0.8 percent) from the previous week. The current economic conditions index fell 3.8 percent to 110.9, reversing some of the sizeable gain posted the previous week (8.9 percent).

The 'time to buy a household item' sub-index rose 1.6 percent last week to 146.3, the highest since January 2016 and well above its long term average (134.0). Four week moving average inflation expectations edged up to 4.6 percent (previously 4.4 percent).

"Given uncertainties about trade protectionism and domestic concerns, we remain cautious about how easily upbeat confidence will be reflected in stronger consumer spending. Indeed, we continue to see a pick-up in wages as essential for a boost to overall household spending," said Jo Masters, Senior Economist, ANZ Research.

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions