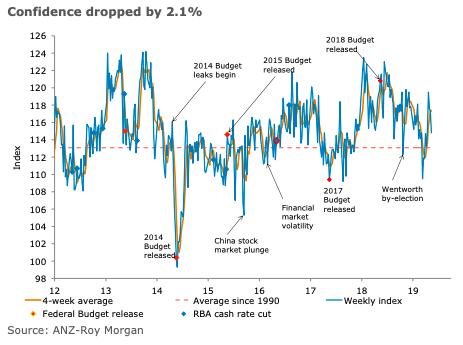

Australia’s ANZ-Roy Morgan consumer confidence fell by 2.1 percent last week, closing below its four-week moving average but remaining above the long-term average.

Financial conditions were not the cause of the fall, with current finances up 2 percent, while future finances rose 1.4 percent.

Economic conditions dropped sharply, however, with current economic conditions down a massive 8.1 percent, continuing their recent volatile pattern, and future economic conditions falling 3.3 percent.

The 'time to buy a household item' also did not help, falling 2.5 percent. The four-week moving average for inflation expectations rose by 0.2ppt to 4.2 percent.

"The fall in consumer sentiment follows a couple of important developments. Domestically the RBA decided to leave interest rates unchanged after considerable speculation that a rate cut might occur. Globally, the US-China trade dispute resumed with the US increasing tariffs on a wide range of goods. At this stage, consumers see these events as more damaging for overall economic prospects than their own finances. After a period of weakness, inflation expectations jumped to 4.5 percent for the week, pushing the four week moving average to 4.2 percent – its highest level since the end of January. The uptrend in petrol prices over the last few weeks may have supported inflation expectations," said David Plank, ANZ’s Head of Australian Economics.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality