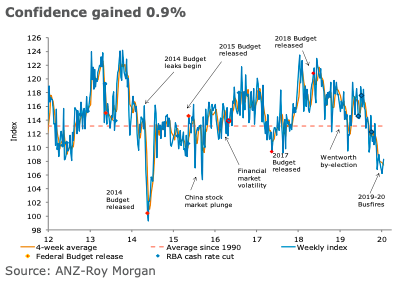

Australia’s ANZ-Roy Morgan consumer confidence continued with its forward march, gaining 0.9 percent last week. This takes it back to where it was in mid-December. The financial and economic sub-indices were mixed, while the ‘Time to buy a household item’ strengthened solidly.

Current finances gained 3.4 percent vis-a-vis weakness of 5.5 percent seen in the previous reading. In contrast, future finances declined 2.5 percent, reversing some of the 4.6 percent gain seen over the three previous surveys.

Current economic conditions gained 2.2 percent, while future economic conditions fell by 3 percent. These sub-indices were up 6.1 percent and 8.6 percent, respectively, in the previous reading.

‘Time to buy a major household item’ was up 4.7 percent, to its highest level since October. Four-week moving average of ‘inflation expectations’ was stable at 3.9 percent. However, the weekly reading was back above 4 percent after two weeks of being below.

"The gain in consumer confidence seen for the second straight week was encouraging, considering the weakness seen in the first reading of the current year. Overall sentiment remains well below average and quite some way below where it was before the RBA started easing in 2019, however. Some welcome rain during the week may have contributed to the overall rise in sentiment, along with some reasonable local data and the signing of the US-China trade deal Phase One. The attainment of a new record for the local share market could also have played a role. The domestic focus this week will be very much on the employment report. A soft result may dampen sentiment somewhat," said David Plank, ANZ Head of Australian Economics.

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal