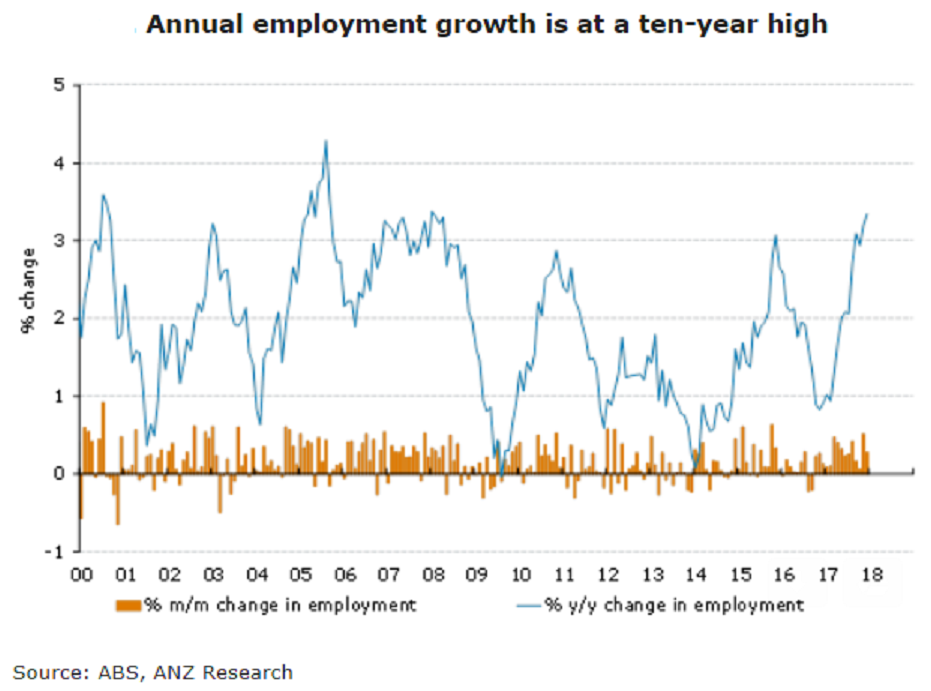

Australia’s unemployment rate is expected to trend lower over the next few months, which should help to support an eventual recovery in wage growth, according to a recent report from ANZ Research.

Looking at the country’s December employment report, we see that the labor market clearly remains in great shape, with another strong gain in employment in December confirming that underlying momentum in the economy remains solid. Encouragingly, the rise in the participation rate to a near record high suggests that the strength of the labor market is pulling more workers back into the labor force.

Employment rose a strong 35k in December, following the upwardly revised 64k rise in November. This is the fifteenth straight monthly rise in employment, a feat which has only occurred once before in the history of the monthly labor force numbers. Full-time employment was solid with a rise of 15k, while part-time jobs rose 20k. Hours worked ticked lower by 0.2 percent m/m, but are still running 3.2 percent above a year ago levels.

The strength was concentrated in NSW (+14k), with Western Australia also posting a solid gain (+6k). Employment fell in both Victoria (-4k) and Queensland (-4k).

"While the strong gains in employment and participation continue to suggest that the economy is in good shape, we remain of the view that there has been some overshoot in the jobs numbers recently and look for more moderate gains in the months ahead," the report commented.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm