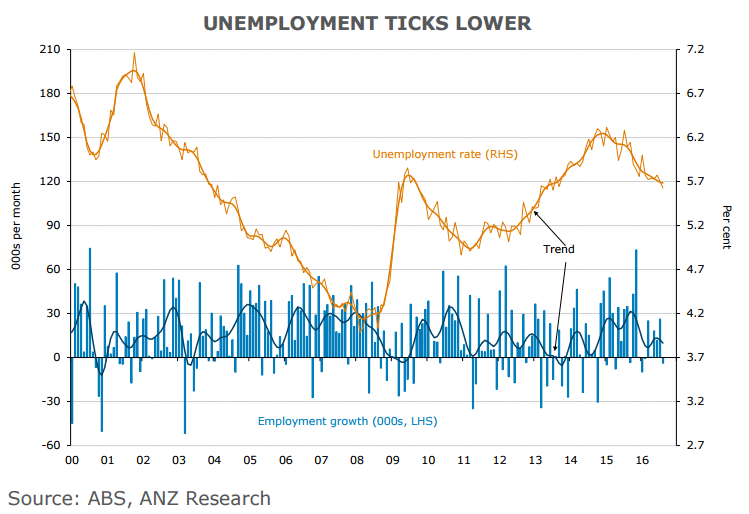

Data from the Australian Bureau of Statistics on Thursday showed Australia’s unemployment rate fell to a three-year low of 5.6 percent in August from 5.7 percent in July, and well below levels of more than 6.0 percent a year ago. 3,900 net new jobs were lost in August, a sharp contrast to forecasts of a 15,000 gain. Full-time positions rose 11,500 in August but the rise was not enough to make up for a plunge in July.

Hours worked fell and underemployment rose in Australia's labor market. The underemployment rate reached a record high of 8.7 percent in August, while the monthly hours worked decreased by 3.9 million. Participation rate of those in work or actively seeking employment fell along with employment. Participation rate, a measure of labor force as a share of population, declined to 64.7 percent from 64.9 percent, missing economists’ forecasts for 64.9 percent.

“Where you have an unemployment rate being brought down by the participation rate ... that is not the ideal way to say it’s a reduction,” said shadow treasurer, Chris Bowen.

The Reserve Bank of Australia (RBA) has already cut interest rates twice this year in response to falling inflation. The RBA recently forecast that inflation will remain below its 2 percent-3 percent target band over coming years, which means interest rates are more likely to fall than rise. Today's data shows spare capacity in the labour market is likely to depress wages and inflation as high spare capacity limits the ability of workers to push for pay rises.

“The continuing softness in full-time jobs and record-low nominal wages growth may partly explain why too many Australians say the economy doesn’t feel as strong as the good GDP growth data suggests,” said Shane Oliver, chief economist at AMP Capital Markets.

Australian shares rose for a second straight session on Thursday, the S&P/ASX 200 index closed up 0.2 percent, or 12.21 points, at 5,239.9. AUD/USD was trading at 0.7476 at around 11:15 GMT. Technical indicators on weekly charts are heavily bearish, scope for more downside. Break below 200-DMA at 0.7396 could see downside upto 0.7145 levels.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January