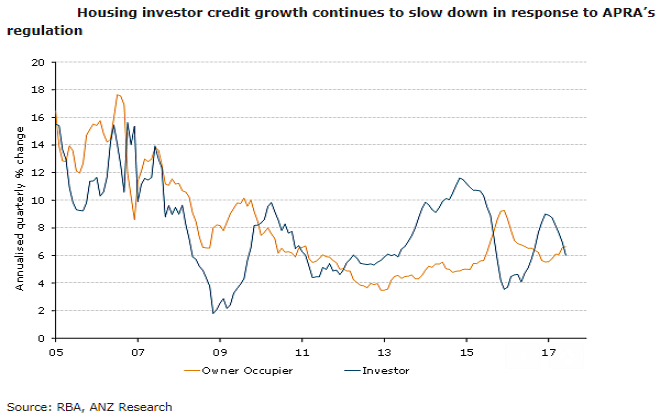

Australian private sector credit recorded a solid increase in June, led by a rebound in the business sector after several months of weakness. The divergence between the investors and owner-occupier housing credit continued, with the former still slowing in response to APRA’s macro-prudential regulation.

Housing credit posted another 0.5 percent m/m rise in June, although at the margin (2 decimal places) this was the slowest monthly increase in a year. The slowdown in investor borrowing continued, and quarterly annualized growth now sits at 6.0 percent.

On the other hand, credit to owner-occupiers again posted faster monthly growth than the investor segment. The divergence between the segments kept total annual housing credit growth at 6.6 percent y/y, reflecting a stabilization at a marginally higher rate than at the start of the year.

Business credit recorded the strongest monthly rise since December 2016, up 0.9 percent m/m. This is a welcome result after a period of weakness, but we do not expect it to be sustained indefinitely. Business finance approvals have remained weak in recent months, and suggest that growth in the stock of business credit is likely to ease from here, ANZ Research reported.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data