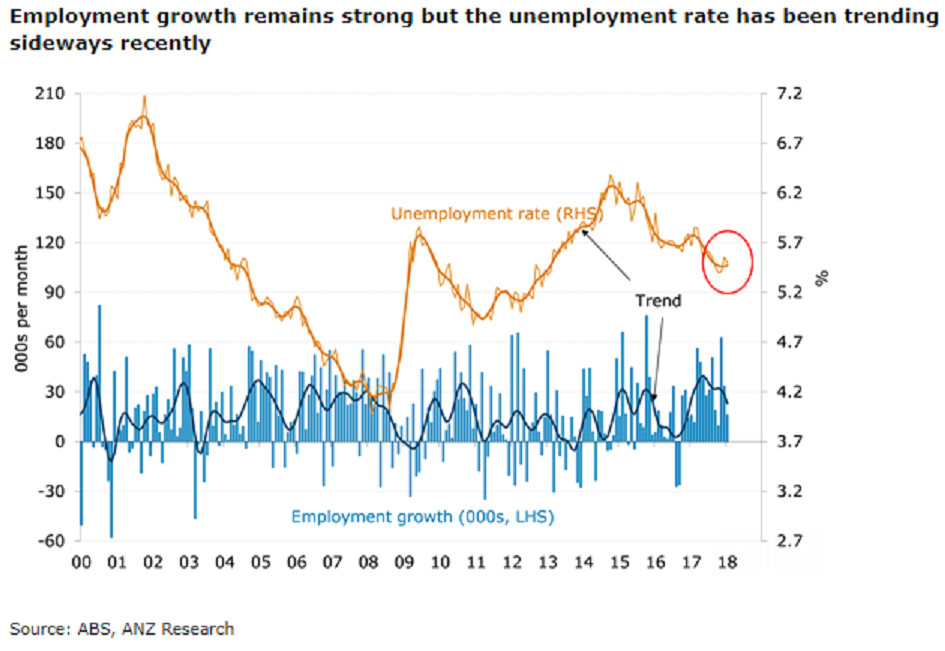

Australian employment rose to a record 16 consecutive monthly gains. The drop in full-time jobs and the recent stabilization of the unemployment rate took some of the gloss off the report, however. Recent stability in the unemployment rate is consistent with the Reserve Bank of Australia’s (RBA) willingness to be patient on policy normalization. That said, leading indicators suggest that employment is likely to grow solidly and the unemployment rate decline over coming months.

After a very strong run, employment rose a more moderate 16k in January, after a 33k rise in December. This is the 16th straight monthly rise in employment, beating previous records including 1994 when Australia was dragging itself out of a deep recession after unemployment surpassed 11 percent.

Putting a dampener on the report was a sharp fall in full-time jobs (-50k). Part-time employment rose 66k. This mix was reflected in hours worked, which fell a sharp 1.4 percent m/m. The national unemployment rate ticked down to 5.5 percent, although this came alongside an upward revision to December unemployment to 5.6 percent, from previous 5.5 percent.

The participation rate nudged slightly lower from 65.7 percent to 65.6 percent. The female participation rate maintained its record high of 60.5 percent, while male participation ticked down to 70.9 percent from 71 percent.

"While we have been expecting a moderation in the employment numbers for a few months now, leading indicators continue to suggest that the labor market remains in good shape. Business conditions and profitability remain very buoyant, and job ads continue to trend higher. On this basis, we expect further gains in employment and a further decline in the unemployment rate in coming months," ANZ Research commented in its latest research report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks