Australian building approvals declined sharply in March, correcting very strong growth in February. However, in trend terms, the decline in approvals of both dwellings and non-residential buildings are flattening. This suggests we may be past the peak period of falling building approvals after the sharp declines in late 2018, according to the latest report from ANZ Research.

The country’s residential building approvals fell 15.5 percent m/m in March, following a 19.1 percent increase in February. The drop in approvals was driven by private sector units, which declined 30.6 percent after jumping 64.5 percent in February. The decline in house approvals slowed in March, at only 3.1 percent m/m, compared with a drop of 3.5 percent m/m in February. Dwelling approvals are down 27.3 percent y/y.

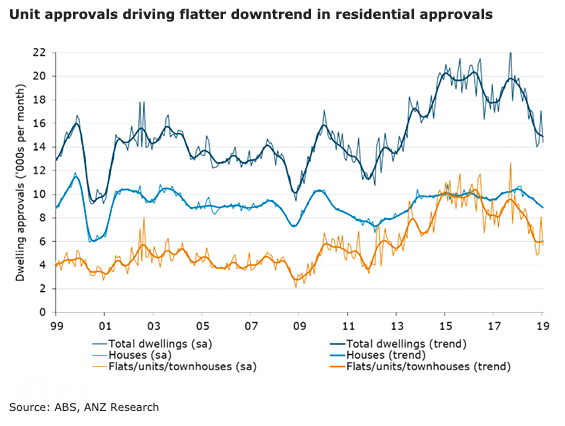

Unit approvals are driving a flatter trend in residential approvals. In trend terms, unit approvals have flattened out at around 6,000 per month since November. This is a moderation from the peak of the trend during 2016, but is still higher than long-run historical trends, at around 4,000 per month.

NSW approvals fell by 27 percent m/m, exactly reversing the jump in February. NSW approvals have flattened out in trend terms over the past few months, but are still falling in trend terms in VIC and QLD. In contrast, the trend level of approvals is stable to higher in SA and WA.

Meanwhile, alterations and additions rose by 2.5 percent m/m in seasonally adjusted terms and 1.2 percent m/m in trend terms. The trend for alternations and additions has risen for the past seven months. The value of non-residential approvals fell by 8.7 percent m/m in seasonally adjusted terms, bringing the annual change in the trend to -12.1 percent y/y.

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target