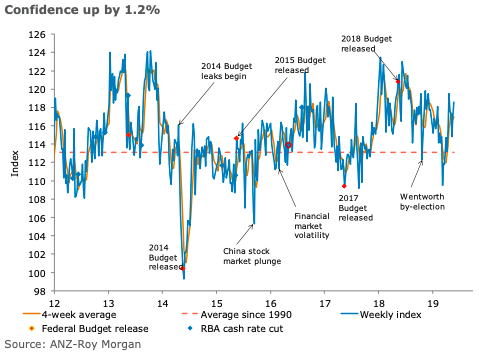

Australian ANZ-Roy Morgan consumer confidence continued to rise, gaining 1.2 percent last week. With the exception of ‘Time to buy a household item’, which fell 2.9 percent, all the sub-indices were positive.

Current financial conditions rose by 1.2 percent, while future financial conditions were up 0.8 percent. These two indices have risen for three consecutive weeks. The measure of current financial conditions is its highest since early February.

Current economic conditions rose 3.0 percent while future economic condition were up 4.5 percent. The four-week moving average for inflation expectations was stable at 4.1 percent.

"Consumers are upbeat about both their personal outlook and the economy in general. The prospect of lower interest rates and what appears to be a major sentiment shift on the housing market are likely drivers of the positive outlook. The gain comes despite negative developments in the global economy. While the four-week moving average for inflation expectations was unchanged at 4.1 percent, the weekly reading dropped back under 4 percent. This is the fifth sub-4 percent reading since early March, an unprecedented run of low results for this survey," said David Plank, ANZ Head of Australian Economics.

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022