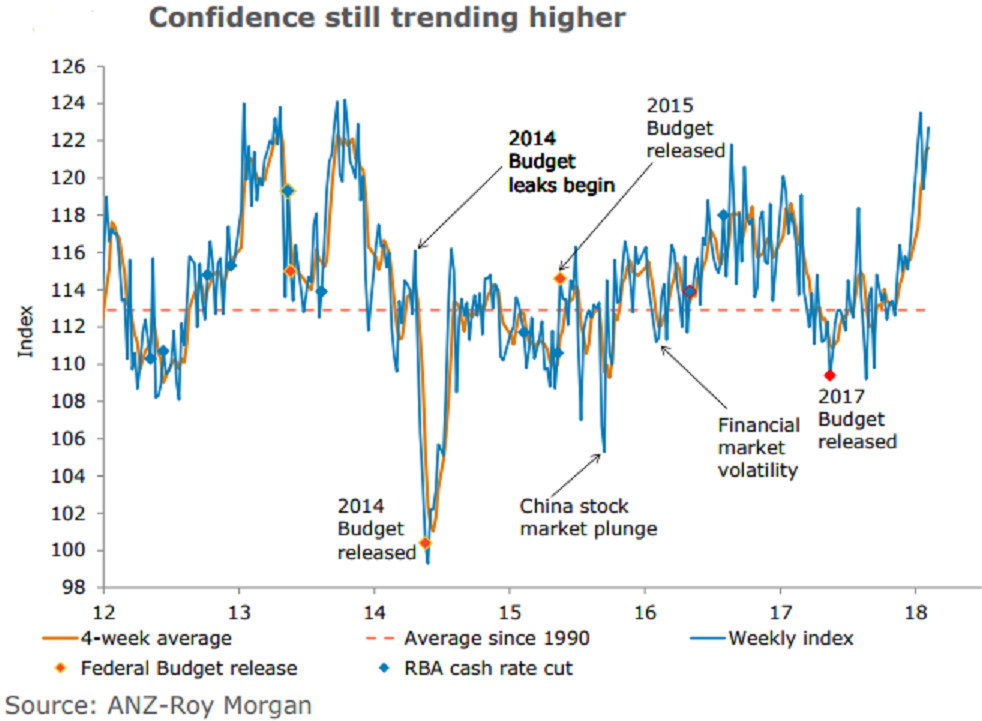

Australia’s ANZ-Roy Morgan consumer confidence rose 1.5 percent last week bringing the headline index to 122.7. The improvement in confidence was driven by increased optimism around current financial and economic conditions.

Households’ sentiment towards current economic conditions rose 4.2 percent to 120.4, the highest weekly value since November 2010. Confidence in future economic conditions slipped 0.4 percent last week, after a solid 4.2 percent rise previously. In four week moving average terms, this series has risen past its long-term average for the first time since December 2013.

Views towards current financial conditions bounced a solid 5.5 percent, partially recovering from the 10.6 percent cumulative fall over the previous two weeks. Meanwhile, future finances edged up 0.6 percent last week after a similar rise previously.

Sentiment around the 'time to buy a household item' saw its third consecutive weekly fall, slipping 1.3 percent to 139.5. The weekly inflation expectations value slipped to 4.2 percent.

"The uptrend in consumer confidence, while broad-based, has primarily been driven by a sustained improvement in views towards the economic outlook. This likely reflects strength in the domestic labor market as well as a global synchronized pickup in activity," said David Plank, Head of Australian Economics, ANZ Research.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility