Today, Australia’s wage growth report was released from Australian Bureau of Statistics (ABS) for first quarter 2016, which along with stronger Dollar took toll on Aussie, which is down -0.4%, trading at 0.729 against Dollar. Wages on an average grew 0.4% in first quarter and 2.1% from a year back, which is weakest level since 1998.

However, data broken up by industry in private sector seems to be doing pretty well, compared to a country hit by commodities’ prices.

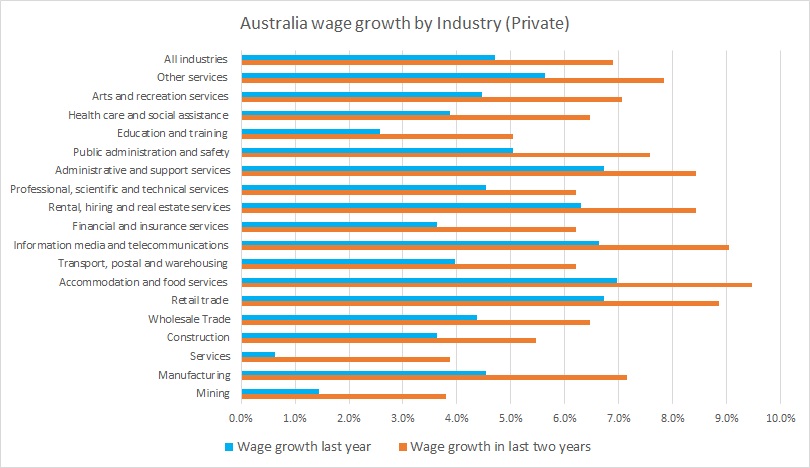

While some industries like mining, services, educations, transport, postal and warehousing haven’t done so well in last year or two, some like accommodations and food services, information media and telecommunications, retail trade, Rental, Hiring and Real Estate services have done very well.

In last one year, wage growth has been worst in services industry, just about 0.6%y/y, followed by mining with just 1.4% but workers in food and accommodation services saw as much as 7% y/y rise. Manufacturing sector (private) saw above 4% rise. If looked closely, as mining and services got hurt, workers in other industries have flourished.

The details by industry is shown in the chart. Kindly note, this data is excluding the bonuses, since bonus tends to be volatile in period of hardship.

India Services Sector Rebounds in January as New Business Gains Momentum: HSBC PMI Shows Growth

India Services Sector Rebounds in January as New Business Gains Momentum: HSBC PMI Shows Growth  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  US-India Trade Bombshell: Tariffs Slashed to 18% — Rupee Soars, Sensex Explodes

US-India Trade Bombshell: Tariffs Slashed to 18% — Rupee Soars, Sensex Explodes  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Australia’s Corporate Regulator Urges Pension Funds to Boost Technology Investment as Industry Grows

Australia’s Corporate Regulator Urges Pension Funds to Boost Technology Investment as Industry Grows  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX