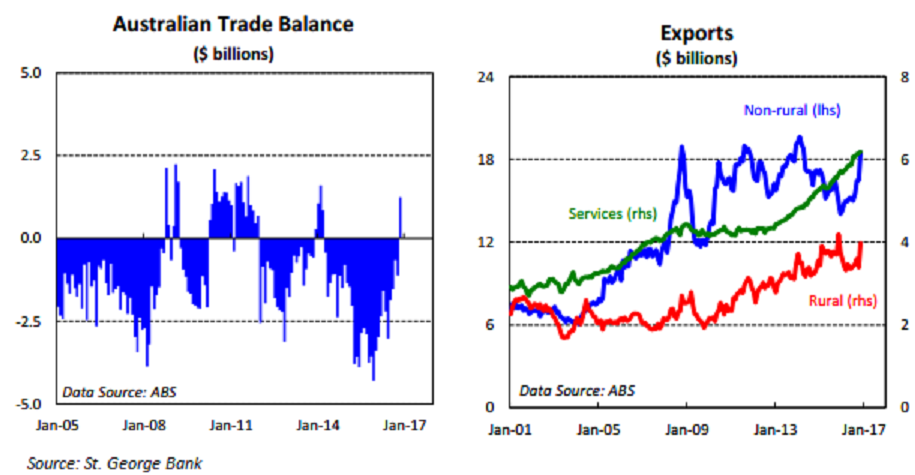

Australia posted a trade surplus for the first time in nearly three years, against market expectations of a deficit during the month of November. The combination of a surge in exports and a contraction in imports delivered the sharp improvement in Australia’s trade position.

Exports jumped 8.4 percent in November, the fastest monthly growth rate since March 2011. Big rises in rural and non-rural exports pushed total export receipts higher in the month. The country posted a trade surplus of USD1.2 billion.

Rural exports posted the biggest monthly gain since December 1995 and non-rural exports the largest since April 2010. A recovery in commodity prices through 2016, especially for the bulk commodities, is feeding through to export receipts.

Imports fell by 0.1 percent in November. Both imports of consumption goods and capital goods were lower in the month, suggesting spending by consumers and businesses could stay sluggish in coming months. In terms of economic growth, net exports are likely to have added to economic growth in the December quarter, a turnaround from the previous quarter when they were a drag, St. George Bank reported.

Meanwhile, AUD/USD traded at 0.73, down -0.26 percent, while at 5:00GMT, the FxWirePro's Hourly AUD Strength Index remained neutral at 11.22 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions