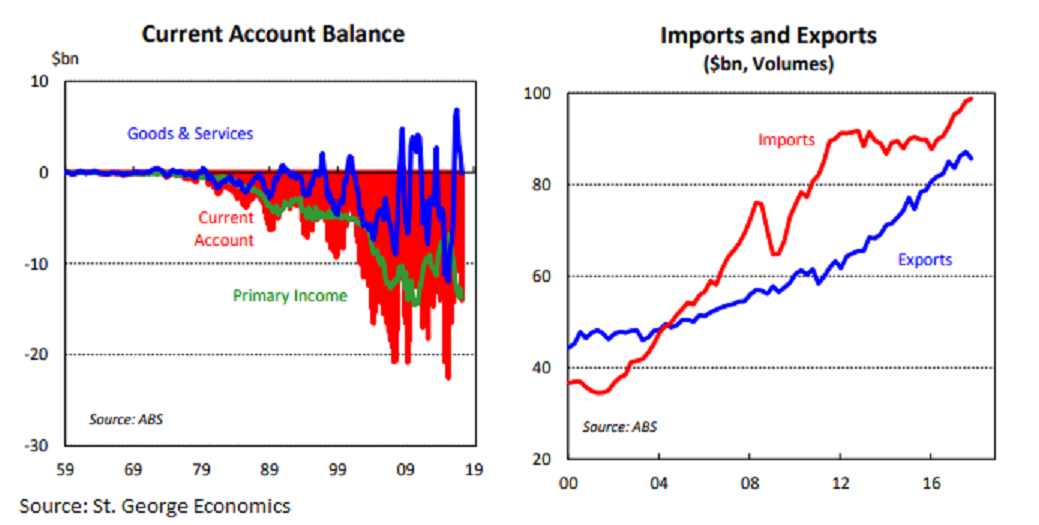

Australia’s current account deficit widened from a revised deficit of AUD11.0 billion in the September quarter to AUD14.0 billion in the December quarter, the largest deficit in over a year. The blow out in the current account deficit was mostly due to a turnaround in the goods and services balance from a surplus of AUD2.0 billion in the September quarter to a deficit of AUD117 billion in the December quarter.

Export volumes were negatively impacted by rural good exports, which fell 9.7 percent, and were affected by poor weather. Coal exports were also temporarily affected, but are expecting to rebound early this year. The combination of weaker export volumes and the lift in import volumes point to a 0.5 percentage point detraction from GDP growth in the December quarter.

"We remain comfortable with our forecast of 0.6 percent GDP growth in the quarter for an annual pace of 2.6 percent," St. George Economics commented in its latest research report.

It represents a moderate pace of growth, not far from the long-run trend. Business investment and public spending are expected to grow modestly and are expected to be the key drivers of growth in the coming year. They are drivers at a time when there are downside risks for consumer spending and as a downturn in dwelling investment takes hold.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains