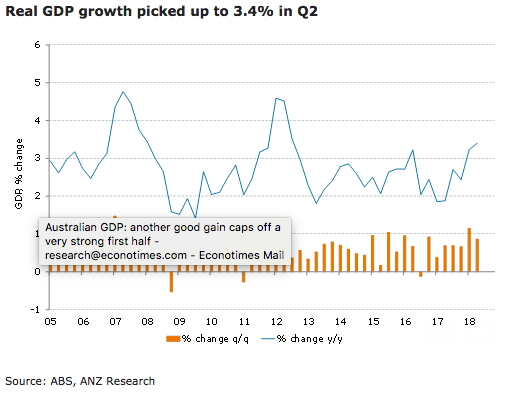

Australia’s gross domestic product (GDP) for the second quarter of this year rose 0.9 percent q/q and 3.4 percent y/y in Q2, much stronger than expectations, capping off a very strong first half where annualised growth was a robust 4.1 percent. The strength was concentrated in housing construction, mining investment and public consumption, while household spending rose a moderate 0.7 percent q/q.

In particular, profits were much stronger than we expected or what the Business Indicators (released on Monday) suggested. Also, mining investment rose strongly, while farm output (and income) also rose. Providing some offset to this was weaker-than-expected non-mining investment and wages, ANZ Research reported.

Overall, the strength was concentrated in public sector consumption (+1.0 percent q/q), housing construction (+1.7 percent) and mining business investment (+5.1 percent). Consumption grew a solid 0.7 percent after an upwardly revised 0.5 percent rise in Q1 (previously +0.3 percent). Net exports made a small contribution to growth (+0.1ppt).

Non-mining investment was disappointing in the quarter (-1.7 percent, excluding the impact of transfers between the private and public sector), however upward revisions leave non-mining investment up a strong 8.8 percent y/y.

Elsewhere, private non-financial profits were up 3.5 percent q/q, while small business profits rose a strong 3.2 percent q/q. In terms of industries, the construction, professional services and health care sectors were the strongest contributors to growth in the quarter.

"The strength of the GDP report vindicates the RBA’s upbeat messaging around the economy and the stronger starting point suggests that the Bank is likely to remain positive about the outlook. Our view is slightly more circumspect, with the strength in H1 unlikely to be repeated in H2, but growth to remain close to 3 percent over the next year or so," the report commented.

Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election