Australia’s gross domestic product (GDP) for the first quarter of this year rose slightly above market expectations, with the strength concentrated in net exports and public spending, while growth in household consumption was softer after the strong gain in Q4. Measures of inflation continued to lift, although they remain low by historical standards.

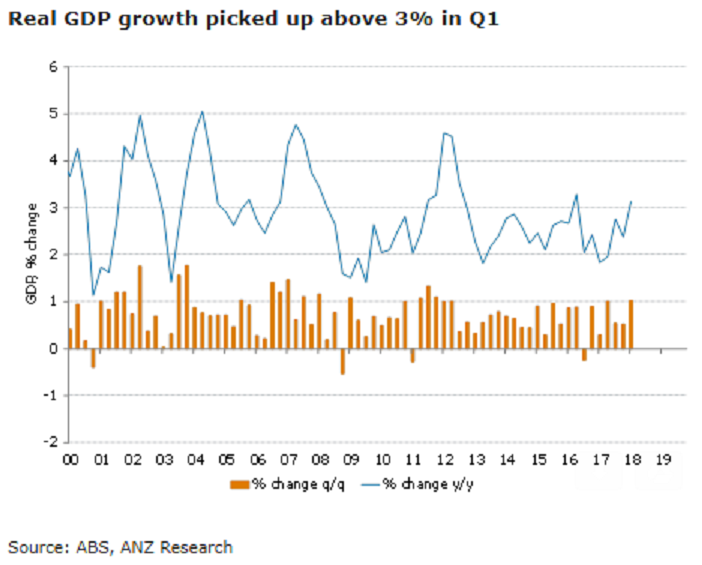

GDP was up a strong 1.0 percent q/q in Q1, which along with upward revisions to earlier data lifted annual growth 3.1 percent. This is the fastest growth since 2016, when growth briefly ticked above 3 percent and only the second time since 2012 that y/y growth has been above 3 percent. The result was a little stronger than our own forecasts and also above the RBA’s forecast published in the May Statement on Monetary Policy.

The rebound in growth was helped by a turnaround in net exports as well as strong public spending and a sharp rise in profits. On the expenditure side, net exports contributed 0.3ppt to the rise, while public sector demand contributed 0.4ppt. Household consumption grew a soft 0.3 percent, although this follows a 1 percent jump in Q4 and leaves annual growth at 2.9 percent.

"The RBA is likely to be relieved with the rebound in growth, but cognisant that the outlook is far from assured. While business conditions remain buoyant, the household sector remains under pressure from soft wage growth, a low saving rate and weakening house prices. The risks to the global economy have also increased. In this environment, and with inflationary pressures still modest, the RBA is clearly on hold for some time," ANZ Research commented in its latest report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength