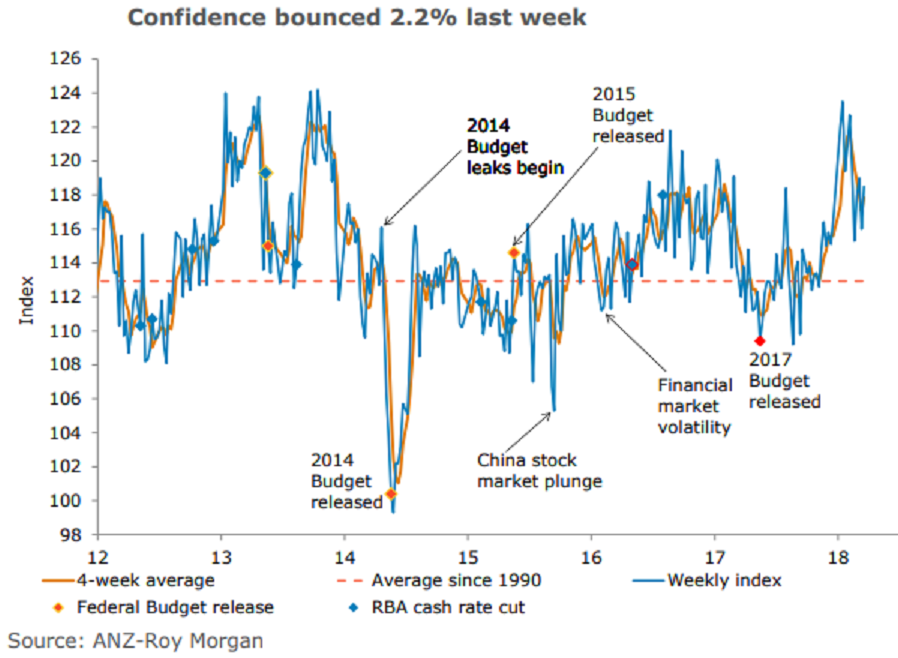

Australia’s ANZ-Roy Morgan Australian Consumer Confidence recovered 2.2 percent last week, largely reversing the previous 2.5 percent decline. The improvement in sentiment was broad-based, with households particularly optimistic about near-term financial conditions.

Views towards current economic conditions edged up 0.3 percent. This sub-index remains well above its long-term average. Sentiment around future conditions rose 1.2 percent, undoing much of the 1.9 percent decline in the previous week.

Household sentiment towards current and future financial conditions improved materially last week (6.4 percent and 2.6 percent, respectively), following consecutive falls in the two previous weeks.

Further, the 'time to buy a household item' sub-index rose 0.8 percent to 134.2. Inflation expectations eased to 4.5 percent on a four-week moving average basis, with the latest reading at 4.1 percent.

"Overall confidence seems to have stabilised after trending down in February. The jobs report out later this week has the potential to impact confidence in the near term. Another solid report with a tick down in the unemployment rate (in line with our expectations) is likely to support confidence, over the coming weeks. That said, confidence is vulnerable to additional bouts of financial market volatility," said Felicity Emmett, Senior Economist, ANZ Research.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk