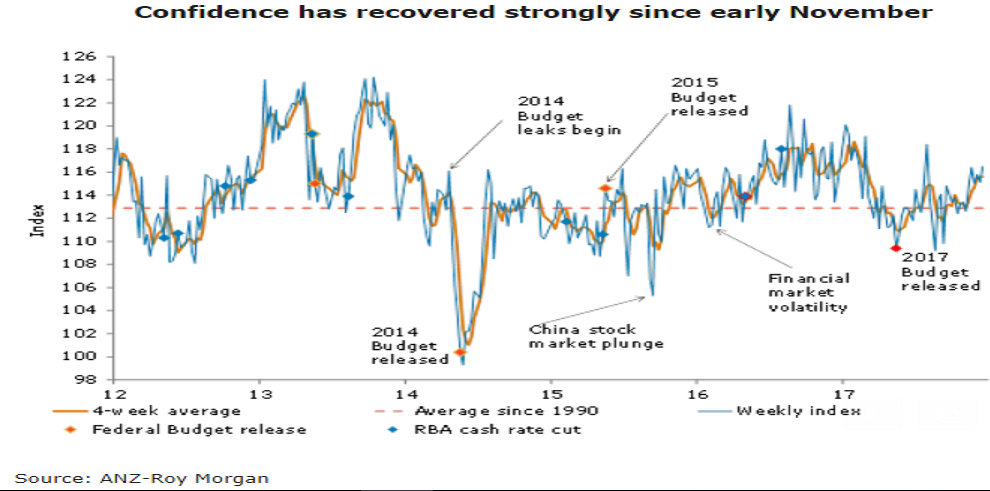

Australia’s ANZ-Roy Morgan Australian Consumer Confidence ended the year at 116.5 with a 1.2 percent bounce last week. The details were positive, with all sub-indices except ‘time to buy a household item’ posting gains.

Sentiment towards both current and future economic conditions rose for the third straight week (2.4 percent and 1.1 percent respectively). This and other gains are indicative of the sustained turnaround in overall sentiment since the low for the year in August.

Views towards current financial conditions jumped a solid 3.6 percent last week, more than offsetting the 2.7 percent fall previously. Views towards future financial conditions improved 0.5 percent last week, following a 2.8 percent fall in the previous week. Both sub-indices currently sit above their long term averages.

Sentiment around the ‘time to buy a household item’ fell 1.2 percent last week. Inflation expectations remained stable at 4.5 percent in four-week moving average terms.

"Even as views towards economic conditions have bounced, confidence in financial conditions, particularly in the near term, has faltered. This reflects a number of headwinds consumers have faced in 2017, particularly persistently weak wage growth and high household debt. As such, we believe that a pick in wage growth is the key to a further improvement in confidence over 2018," said David Plank, Head of Australian Economics, ANZ Research.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off