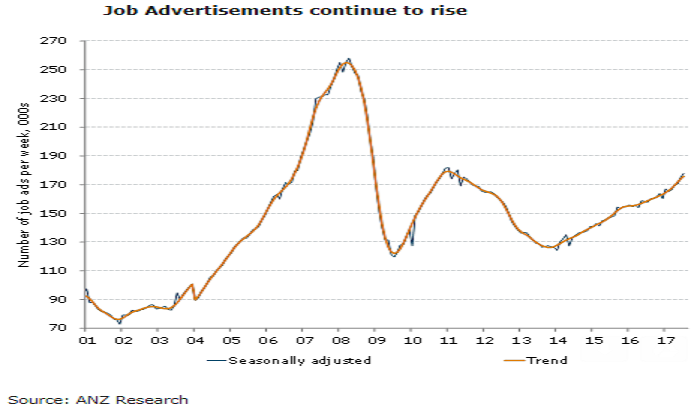

Australia’s ANZ Job Advertisements continue to trend up, rising 1.5 percent m/m in July in seasonally adjusted terms. Total job ads are now up 6.5 percent since the beginning of the year. Annual growth picked up from 10.5 percent in June to 12.8 percent this month.

In trend terms, Job Advertisements were up 1.0 percent m/m in July following a 1.3 percent rise in the previous month. The trend growth rate has averaged 1.1 percent m/m over the first seven months of the year, compared to 0.3 percent m/m over the same period a year ago.

Recent data has shown a clear improvement in labour market conditions consistent with elevated business conditions, profitability and capacity utilisation. In particular, the strength in full-time employment and a solid increase in hours worked (near 3.3 percent y/y) are quite encouraging.

"Broadly, forward indicators and survey based measures point towards near-term jobs growth in the order of 15-20k per month. Given the importance of the labour market and wage growth to the course of monetary policy, we will be closely watching the Q2 Wage Price Index number, out on August 16," said David Plank, Head of Australian Economics, ANZ Research.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady