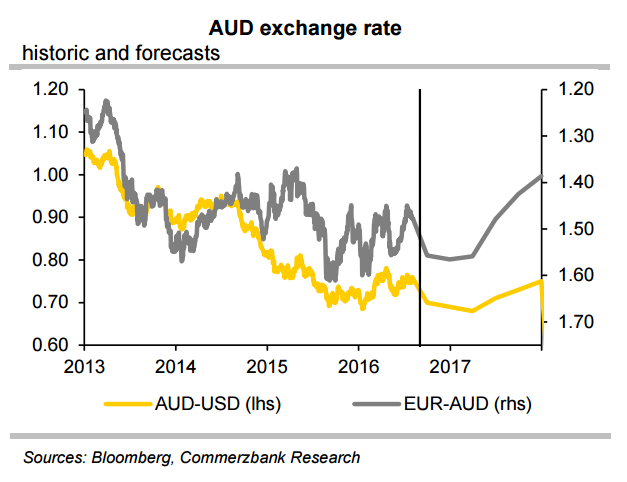

In reaction to the notable appreciation of AUD since the start of the year, the Reserve Bank of Australia (RBA) has reacted in May and as recently as in August and lowered its key rate by 25bp respectively to a historic low of now 1.50 percent. Despite the rate cuts, the RBA was unable to reverse the currency effect. The Australian dollar is up around 11 percent against its US counterpart since the beginning of 2016.

The appreciation of the Aussie since the start of the year is mainly due to the fact that the FX market has priced out Fed rate hikes. Following the surprisingly weak US GDP data for Q2 last Friday, rate expectations were lowered further and would probably take the Fed a whole series of good data to reconsider a rate hike. The Aussie also remains sensitive to changes in the growth outlook, commodities and “monetary policy decisions in Australia or elsewhere”.

The RBA is concerned that a strong currency could “complicate” the process of economic adjustments. A weaker AUD would definitely help by compensating the negative effects of falling commodity prices and put upward pressure on inflation by increasing import prices. Though commodity prices have picked up a little recently, they are still well below the levels of 2014. The RBA expects that in particular iron ore and coal prices, which are important for Australia, will continue to suffer from weak Chinese demand for a while yet.

The inflation measure preferred by the Reserve Bank of Australia (RBA), the trimmed mean, has remained below the RBA’s target range of 2-3 percent during the first half of this year. That said, underlying inflation trend will slowly start to rise again and inflation will be back on target in 2017. While a stabilization of commodity prices should support AUD in the second half of the year, the AUD will nevertheless lose ground against the USD when the Fed begins to hike.

With regards the EUR-AUD, ECB action will dominate developments towards the end of the year. No new expansionary measures are expected from the ECB in the short-term, but further easing measures likely in late 2016.

"FX market will struggle to price out Fed rate hikes any further so that AUD-USD is likely run out of steam on the upside soon. On the other hand that is likely to mean that the RBA will probably have to accept higher AUD levels until a Fed rate hike becomes more likely again," said Commerzbank in a report.

Market attention now turns to the very important US Non-Farm-Payrolls data which is likely to influence perception towards imminent Fed rate-hike decision. AUD/USD was trading at 0.7662, while EUR/AUD was at 1.4550 at around 10:50 GMT.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty