From a central bank perspective, the main change since we last published has been a shift in the RBA’s commentary on the economy. The RBA has dropped references to 3% GDP growth in recent communications, preferring to note that recent data “are consistent with ongoing moderate growth.”

At the same time, the RBA has also acknowledged the recent lift in the unemployment rate. So while the RBA is yet to officially downgrade growth forecasts, it certainly feels as if the distribution of risks to the forecast set are starting to tilt to the downside. We continue to expect 50bp of cuts from the RBA in 2H17.

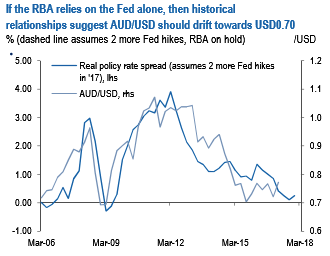

We forecast AUD to JPY 79 and against USD at 0.69 levels even if the RBA does not deliver easings in 2H17, three hikes from the Fed in 2017 will still leave minimal carry support for AUD (refer above chart), which is particularly important given its vulnerability to a turn in China’s momentum or adverse developments in global trade.

Please be noted as to how much the underlying pair has tumbled in spot FX markets in the recent times, we’ve run through in our technical write up, please go through following weblink:

Accordingly, in the recent past, we’ve already advocated options strategies to arrest the bearish risks. For more details on our previous write up on this stance please visit below weblink:

http://www.econotimes.com/FxWirePro-AUD-JPY-macros-outlook-and-option-trades-perspectives-685318

Well, by now you must’ve been convinced what would our previous strategy have earned or saved your trading exposure in this underlying pair of AUDJPY. Subsequently, for now, we continue to uphold these option trade recommendations with a view to tackling both short-term as well as the long-term puzzling trend:

Hold a 6M 80.00 AUDJPY one-touch put, short a 3M in premium-rebate notional.

Hold 3M AUDUSD ATM vs short 1Y AUDJPY 25D Put, 1.5:1 AUD vega.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says