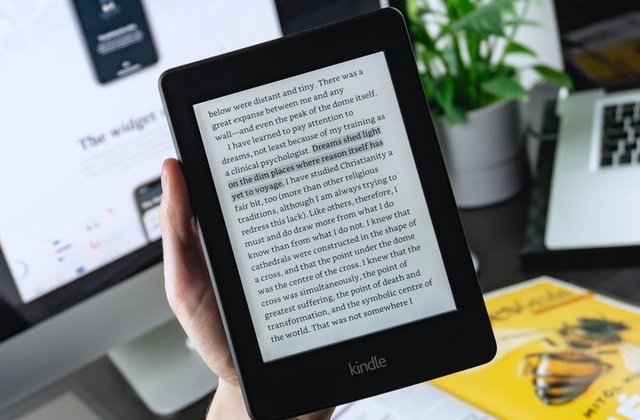

Amazon runs a Kindle store in China, and people usually buy their e-books here. However, the American tech and e-commerce firm stated on Thursday, June 2, that it would close down the e-bookstore.

According to Reuters, Amazon will no longer operate its Kindle store in China, and it will only be open until June 30, 2023. From this date, Chinese customers will not be able to buy new e-books.

Amazon will also totally stop supplying resellers with its Kindle reader, and this will be immediately in effect. The company did not provide any reason for the decision, and it only announced the pullout through its official WeChat account, which is widely used in China.

CNBC noted that Amazon’s shut down of its Kindle e-book store in China is the latest exit by an American tech company in the Chinese market. The company confirmed that it has already stopped furnishing third-party sellers with its Kindle devices, although some of the units are still up for sale on Amazon’s official store at JD.com, a Chinese e-commerce company headquartered in Beijing.

Chinese customers who previously bought e-books from Amazon’s Kindle store will still be able to redeem or download their purchases until June 30, 2024. These e-books will also be available and readable even after the end of the downloading date.

Then again, while Amazon is removing its Kindle store, it said that it is not completely pulling out its business in China. Jeff Bezos’ company said that it will still continue to operate some of its existing businesses in the country, including its logistics, devices, and ads.

“Amazon’s long-term development commitment in China will not change,” the firm said in a separate post on Weibo, another popular Chinese social media platform. “We have established an extensive business base in China and will continue to innovate and invest.”

In any case, Amazon started selling its Kindle e-readers in the country in 2013. The device quickly became popular among the Chinese, and it eventually became an important Amazon item in the device and tech market.

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns