WTI is struggling to make gains as tension surrounding Middle East has eased somewhat and as of now, there are no threats to oil supply.

Key factors at play in Crude market

- Saudi Arabia in recent days have signaled this week that it might finally cooperate with both OPEC and non-OPEC producers but OPEC is still producing way above its target of 30 million barrels/day.

- OPEC members will hold summit in Vienna this week on 4th.

- Tensions have eased in Middle East.

- According to IEA it might take until 2020 for oil to reach $80/barrel.

- Due to new and improved technologies, crude oil production cost has declined for shale producers.

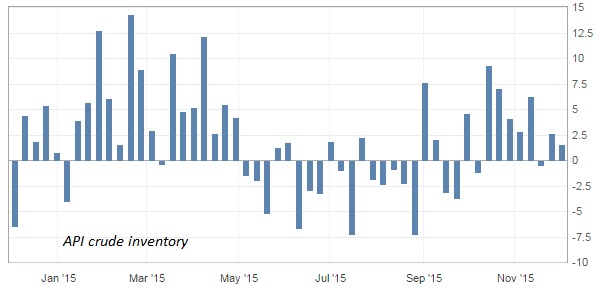

- American Petroleum Institute's (API) weekly report showed inventory rose by +1.6 million barrels.

- Oil price is down, however lack of investments in the sector make prices vulnerable to supply shocks in future.

Today's inventory report from US Energy Information Administration (EIA), to be released at 15:30 GMT.

Trade idea

- We at FxwirePro remains committed to downside, however correction might extend to as high as $47/barrel.

- Moreover, we feel there is a short term opportunity to sell WTI at current price of $41.3/barrel, with stop loss around $42.7/barrel and target around $38/barrel.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022