Although WTI crude has shown a little surge in its price, from last 3 days it was unable to sustain these gains, we look out for a drag up to 39.90 levels.

The ongoing robust level of crude oil production is likely to have played its part in this. On NYME, WTI crude for January delivery traded in a broad range between $41.52 and $42.60 a barrel on yesterday.

Global oil production is outpacing demand following a boom in U.S. shale oil output and after a decision by the Organization of Petroleum Exporting Countries (OPEC) last year not to cut their supply quota.

Hedging Framework with diagonal back spread:

Let's just visualize hypothetical scenario contemplating current downtrend of WTI crude to extend.

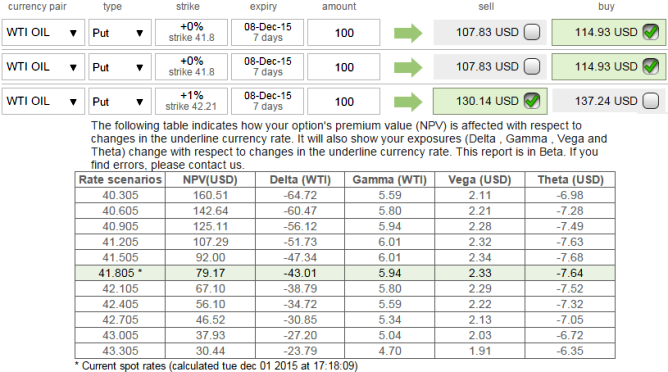

As shown in the diagram, Spot WTI oil is currently trading at $41.77.

An options trader who is bearish on this commodity executes 2:1 put back-spread by shorting a near month 3D (1%) in the money put for $130.14 and buying 2 lots of 15D at the money -0.49 delta puts for $114.88 each. So thereby the net debit to be paid at $99.72 to enter the strategy.

Scenario 1: On expiration after 3 days, if WTI crude flies beyond 42.19 or remains stagnant at that levels which is our near term technical resistance, our initial premiums receipts are going to be certain yields.

Thereafter, testing this resistance and dips backwards towards targets at 39.90 areas then both the long puts expires in the money as there is no question of excising rights (entire US$ 130.14 can be pocketed in). Buying back this put to close the position will result in the maximum loss of $500 for the options trader.

Scenario 2: In case WTI crude dives to $39.90 level or below on expiration, all the options advocated above would expire in the money.

The short side is worth more and needs to be bought back to close the position.

Since the two long puts were bought is now worth double, their half of combined value would be enough to offset the losses from the written put. Therefore, the strategy is able to achieve breakeven at $40.20.

Note: For demonstrated purpose we've used identical maturities, consider longer tenors on long side and shorter tenor for writing. The positions could be constructed with net delta at -0.43 and vega at 2.43.

FxWirePro: WTI crude still weaker; a run through on hedging

Tuesday, December 1, 2015 12:05 PM UTC

Editor's Picks

- Market Data

Most Popular