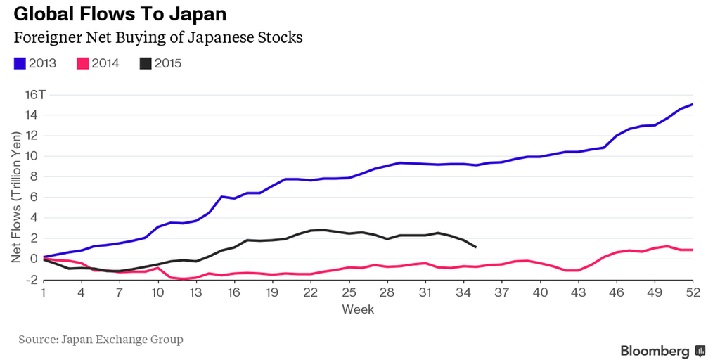

According to latest data from Japan's finance ministry, 2015 proving to be tough year for Japanese equity inflows, which after growing positive initially has turned sour and falling at fastest pace in at least a decade.

Recent sharp drop in Japanese equity markets, over last week's massive risk aversion, revealed fragility in the stock valuation. Since then Japanese equity has remained underperformer among global peers.

Japanese equities valuations have benefited largely from heavy global inflows as Bank of Japan (BOJ) started purchasing assets (mainly government bonds) at record pace of ¥80 trillion per annum.

Though Bank of japan (BOJ) hasn't slowed purchase, equities in Japan is at greater risk of larger pull back.

Why?

- Quantitative easing from European Central Bank (ECB) has pushed Euro lower against all currencies even Yen, thus taking away Japanese companies global advantage.

- Heavy depreciation of emerging market currencies and recent devaluation of Yuan by China is likely to offset some of the benefits of weaker Yen.

The chart from Bloomberg shows, foreign inflows to Japanese equities since 2013.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?