Ahead of RBNZ’s monetary policy meeting that is scheduled next week, the market pricing for a November OCR cut has been stable during the past two weeks at around 80% (currently 86%).

Q3 CPI data was unsurprising to RBNZ forecasts, although it did surprise a number of analysts who expected something lower.

The markets have consistently priced in a greater than 50% chance of a November cut since Assistant Governor McDermott’s speech in September reminding all that the “promised” cut remains in the pipeline.

So what could spook them from cutting? A sharp rise in inflation expectations on 2 Nov (unlikely, given CPI is running at only 0.2%/yr), or a plunge in the NZD, come to mind. We continue to expect a cut on 10 Nov, followed by a lengthy pause.

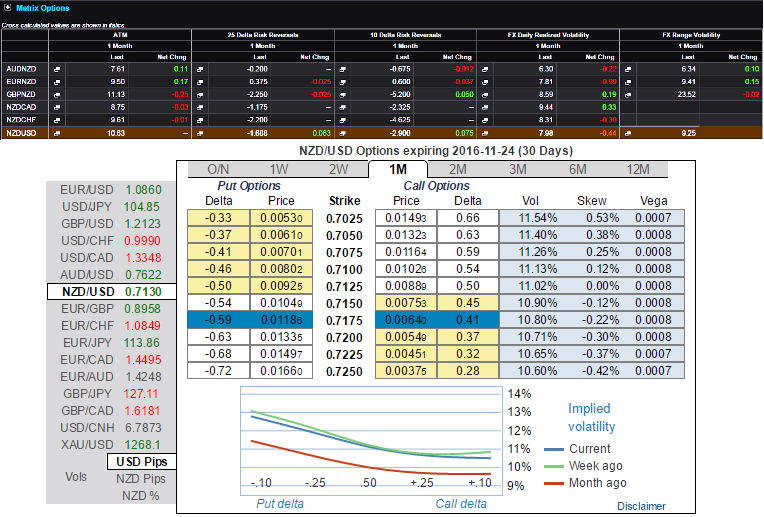

Consequently, the participants in NZD OTC market are getting active, 1m IVs are screaming off over 11.02% and positive skew is observed in OTM put strikes.

Implied volatility is elevated compared to realized volatility (see above nutshell), suggesting a structure selling it.

The downside skew is not sufficiently elevated to finance a put via low strikes (a put spread-like structure), but the negative skew is enough to obtain an attractive discount via a downside knock-out. Such a barrier is appropriate for trading moderate NZD/USD downside.

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal