The consumer prices rose by 0.2% in the September quarter, in line with our expectations but ahead of the median market forecast for a flat outturn.

The Reserve Bank had forecast a 0.1% increase in its August Monetary Policy Statement.

The annual inflation rate slowed from 0.4% to 0.2%, just above the record low of 0.1% that it briefly touched in December last year.

Today’s release doesn’t fundamentally change the picture for the RBNZ.

FX Outlook and option strategy:

The slight downward grind this year has morphed into a more sideways grind centered on 74.

It’s approaching a breakout, with perceived BoJ direction likely to dictate whether the break is upwards or downwards. It’s low key calendar this week, except the dairy price index.

Most importantly, the market pricing for a November OCR cut has rebounded over the past week, from 66% to 84%, in good part due to RBNZ McDermott’s reminder the OCR will be cut further.

There’s final Aug IP on Mon, and department store sales as well as final machinery orders on Tue.

None of this should shift views on the yen though the next BoJ quarterly update is only 2 ½ weeks away, so press stories on what the BoJ might and might not do should start to proliferate.

On the medium term perspectives, a reluctance to cut BoJ leaves the cross vulnerable to a fall below 72.0.

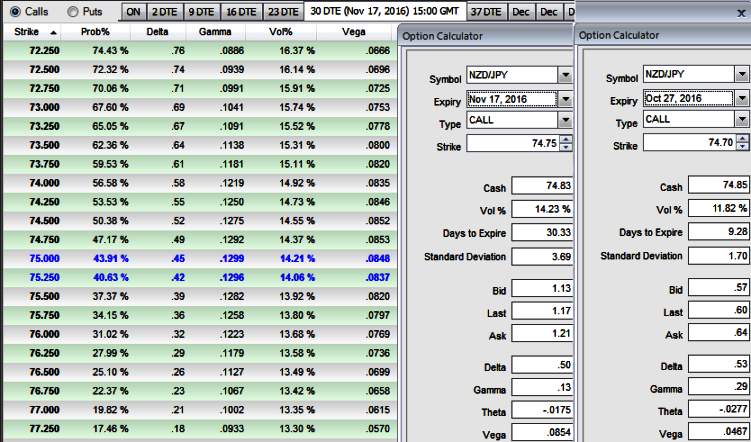

The execution of option strategy: Diagonal Put Ratio Spread (DPRS)

Go long in 1m ITM -0.71 delta put options, while simultaneously short 2 lots of 1w (1%) OTM puts with positive delta.

This spread is a neutral strategy that involves buying a number of put options and writing more put options and maturity at a different exercise price with reduced debit.

It is the limited returns with the unlimited risk options trading strategy that is executed when the options trader reckons that the underlying spot FX would experience little volatility in the near term.

1w ATM IVs are just shy above at 11.8%, and a tad below 14.25% in 1m tenor.

The long leg of the strategy would monitor major downtrend and prevailing upswings would make OTM shorts go worthless. Thereby, the total cost of the strategy would be reduced while bearish risks in the major trend would also be mitigated.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data