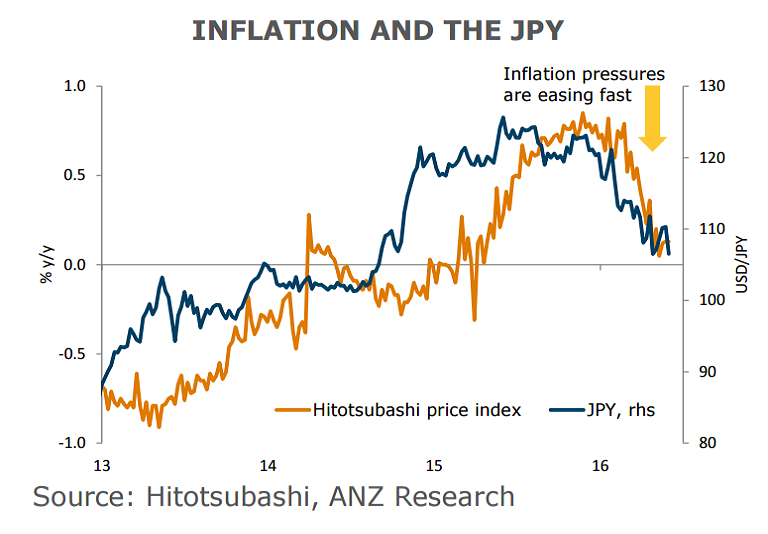

Policy outcome expectations from the BOJ's two-day rate review meeting ending on Thursday are a little mixed. Expectations for this meeting are divided on whether the central bank will move or not. Underlying price dynamics continue to be poor, wages remain subdued, inflation expectations are declining, and high-frequency price data continue to show a sharp deceleration in inflation pressures.

"Kuroda may deliver on some easing this week while keeping the bazooka ready for another time. In terms of further easing, when it comes, we expect JPY10-20trn per annum more in asset purchases (JGBs and ETFs) and a further cut to the negative deposit rate." said ANZ Research in a report.

Safe-haven demand for the yen is noticeable as a result of uncertainty heading into EU referendum. Brexit fears-led risk-off moods will continue to fuel demand for the traditional safe-haven Yen. Excessive appreciation of the JPY would not just adversely impact inflation, but the business confidence and activity as well. Sagging inflation and a rising yen are threatening Bank of Japan's efforts to revive the economy strengthening the case for further easing. All options open for the central bank, including more asset purchases, as well as taking the discount rate further negative.

However, the BoJ is likely to hold off this week, as a Brexit event may undermine any positive impact from easing. When the BoJ introduced negative rates in January, heightened volatility induced safe haven buying of JPY, and countered the BoJ’s hope of a weaker currency. Market turmoil that may result from a possible U.K. vote to leave the EU would drive the yen sharply higher and more than nullify the effects of any additional policy action. It is thus more likely that the BoJ will hold fire until after the June 23 referendum.

"We view further easing by the BoJ as unlikely. Given the recent risk of a Brexit, the BoJ naturally has to be cautious regarding taking additional easing measures ahead of the UK referendum. Although we are maintaining our official outlook that the BoJ will lower its negative policy interest rate a further 0.1% in Jul-Sep, we believe that the need for further easing has decreased somewhat with the more pro-active fiscal stance of Abenomics." said Deutsche Bank in a report.

The dollar slid to 105.62 yen on Tuesday, its lowest since May 3, as investors bought the safe-haven yen on Brexit fears. USD/JPY pared some losses and was trading at 105.94 at 1200 GMT.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate