With the ECB willing to do more, by stepping up its asset purchase program in December and even cutting the deposit rate further, the expectations are running high for the Swiss National Bank to step up its efforts to prevent the Swiss franc from strengthening against the euro. Members of the SNB have also signaled that it could do more. A few statements from Swiss bankers are worth mentioning here:

Andrea Maechler said that "We take note of certain measures that could be taken by other central banks, and we will decide whether we need to or not" and "negative rates are an extraordinary tool given the state of global economy, not for the long term".

Thomas Jordan said that "The SNB is ready to intervene, if necessary. The deposit rate could go lower, but is appropriate for now. Market participants probably argue that cheapest option for the SNB is probably to lower rate, as the total balance sheet has increased to more than CHF600 billion."

The SNB abandoned its cap on the franc in January and is instead using negative interest rates and interventions in the forex market to reduce the safe haven status of the currency. The Swiss currency soared against the single currency after the 1.20 per euro cap was dropped and remains about 10 percent higher since January. Deflationary pressures in the country are on the rise. Rout in commodity prices which drive a substantial part of total inflation are adding to downward pressure. Inflation expectations will probably be revised downwards during the next SNB meeting, mainly due to the fall in oil prices and other commodities.

As the negative impact of the strong franc on Switzerland's export-driven economy becomes more tangible, calls for the SNB to adjust its course are growing louder. There is a strong probability that the SNB might pre-empt their Eurozone colleagues with interventions and rate cuts. Market participants still have confidence that the SNB can manage to prevent the franc from appreciating further.

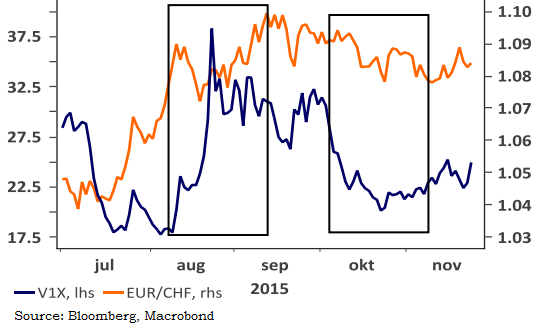

The Swiss franc is not the first choice as a safe haven for investors anymore. During the tensions stemming from China, the Swiss franc remained comfortably above the 1.08-handle. More recently, after the terror attacks in Paris, the Swiss franc even weakened vis-à-vis the euro and the dollar. In fact, the correlation with a volatility index such as the VDax has become positive, indicating that bouts of volatility will result in a weakening of the Swiss franc.

"SNB to lower the 3-month Libor target rate to -1% at the meeting on 10 December. The SNB has probably realised that earlier cuts in the deposit rate have stopped new safe haven flows to some extent and it seems willing to respond to another rate cut and more bond-buying by the ECB", says Rabobank in a research note.

EUR/CHF is trading at 1.0814 as of 1130 GMT, slipping from session highs at 1.0846. USD/CHF has made a high of 1.02296 and slightly retreated from that level to currently trade at 1.02111.

Will the SNB pre-empt its Eurozone colleagues with interventions and rate cuts?

Wednesday, November 25, 2015 11:45 AM UTC

Editor's Picks

- Market Data

Most Popular

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence