Central banks in Europe are discovering an old dilemma: when they lower interest rates because inflation is slowing down, it’s likely to weaken their currencies. This in turn may delay the fall in inflation towards their canonical 2% target.

The Swedish Riksbank experienced this first hand when it cut rates on May 8 and saw the Swedish krona slide against the euro and US dollar. The krona had already depreciated by several percentage points in anticipation of this move. Something similar might happen to the euro if the European Central Bank (ECB) cuts rates as is widely expected on June 6.

More generally, traders are betting heavily that countries whose central bank looks poised to cut rates will see their currencies plummeting. We’re seeing this with the British pound, for instance, with the Bank of England recently signalling that it too might start cutting in June.

The transatlantic divide

The concern that cutting rates leads to currency depreciation is not new, but in recent years it has been obscured by the fact that the burst of inflation and its subsequent fall were largely synchronised across the developed world. This meant their monetary policies were in lockstep, so countries’ currencies were roughly in line with one another.

However, important differences have emerged lately. The US economy remains very strong, whereas the euro area and UK have not grown over the last quarters and the outlook remains much weaker there. This has meant comparatively more inflationary pressure in the US than in Europe.

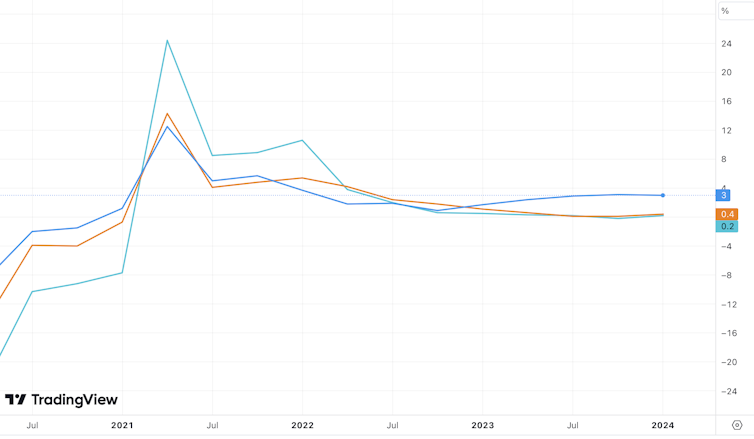

US vs European GDP growth

US = blue; UK = turquoise; eurozone = orange. Trading View

So far, the variation in inflation data has been modest, but this divergence in growth has important implications for monetary policy. Central banks know their decisions take time to take effect, so they’re always trying to act according to where inflation is heading, not where it was over the last months.

When we see the euro area, UK and also Sweden planning to cut rates while the US Federal Reserve is talking about “higher for longer”, it’s therefore being driven more by differences in GDP growth than inflation readings.

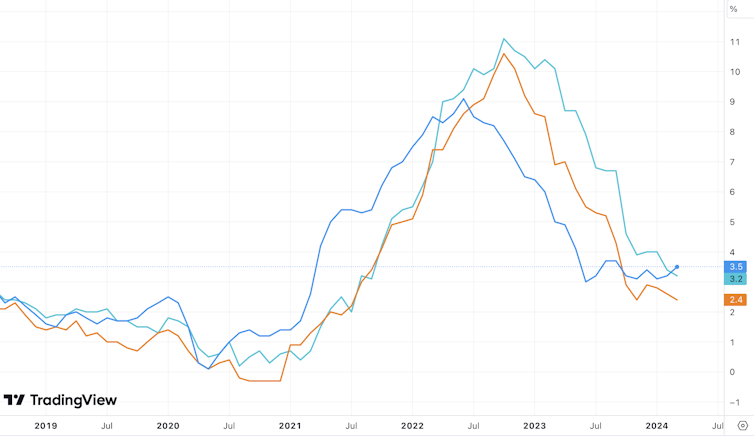

US v European inflation

US = blue; UK = turquoise; eurozone = orange. Trading View

You can see this by looking at medium-term interest rates, which are set not by central banks but by the debt markets, and incorporate expectations of what central banks are likely to do next. For example, 1-year interest rates in the US have remained above 5% and very close to the Fed’s 5.25% to 5.50% target for its benchmark interest rate. This indicates that investors expect the Fed to keep the benchmark rate at today’s levels for another year.

By contrast, 1-year rates in the euro area are 3.4%, more than 0.6 percentage points below the ECB’s benchmark rate. The situation in the UK is similar.

This large difference in expectations makes the US dollar more attractive to investors, since it broadly means they can get paid more interest by buying and investing dollars. We know from recent research by the Fed that this has continued to be the case during the inflationary period of the past couple of years.

A cut by the European central banks would increase the difference in medium-term interest rates even further. This could potentially weaken their currencies considerably.

The implications

A weaker currency stimulates growth, but also puts pressure on prices via imports. This is welcome when inflation is too low because it reinforces the direct impact of a central bank cutting interest rates. Today, however, there is a risk that a weaker currency could further aggravate inflation and delay the time it takes to return to the 2% target.

But is this concern justified? It does not seem so.

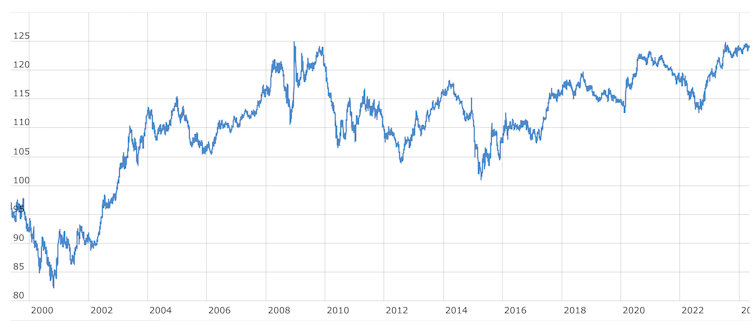

Any fears of a currency plunge seem far-fetched when you look at nominal effective rates, which refers to a currency’s value against a basket of international rivals. The euro’s nominal effective rate is presently hovering at close to its historical maximum. The UK pound’s is not trading at a low level either – at least compared to the recent past – and has appreciated by about 10% over the last 18 months.

Euro nominal effective rate

Experience has also shown that a weak currency does not actually ignite inflationary pressures in practice. For instance, the euro fell to record lows in its early years in the 2000s, but inflation barely budged. The ECB estimates that a 1% depreciation in the euro only increases annual inflation by 0.04%. This means that even a 10% euro depreciation would only produce an 0.4% inflation increase.

The reason why the impact of the exchange rate on inflation is small is thought to be because of retailers. They often keep their prices stable even when currency depreciation means that they have to pay more for imported goods.

It is therefore unlikely that European central banks will be prevented from cutting rates by currency depreciation. What should make them hesitate is the unusually high uncertainty surrounding the inflation path at present. This is because we’re living through a unique combination of recovering from the COVID recession and the aftermath of the energy-price shock caused by the Ukraine war.

Standard economic models would predict a smooth return of inflation to the 2% target, but these are unlikely to be useful to central bankers in such unusual circumstances. A recent report from the International Monetary Fund (IMF) argued that this uncertainty is a reason to move slowly with rate-cutting to ensure that central banks can re-establish their reputations as inflation fighters.

According to the IMF, keeping rates high in this environment entails a smaller disruption than cutting quickly only to find that inflation does persist and rates must be raised quickly again. This “better safe than sorry” argument implies keeping rates on hold until inflation returns to target levels.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns