Several post-referendum inflation reading will be published today by National Statistics (ONS) that need to be monitored closely to assess the first knee jerk reaction to prices due to the referendum. At one hand, deteriorating consumer sentiment is likely to exert pressure on the downside, whereas the sharp drop in sterling could provide a sudden push upwards, especially to the input cost of the producers.

Let’s review the price indices that would be released today-

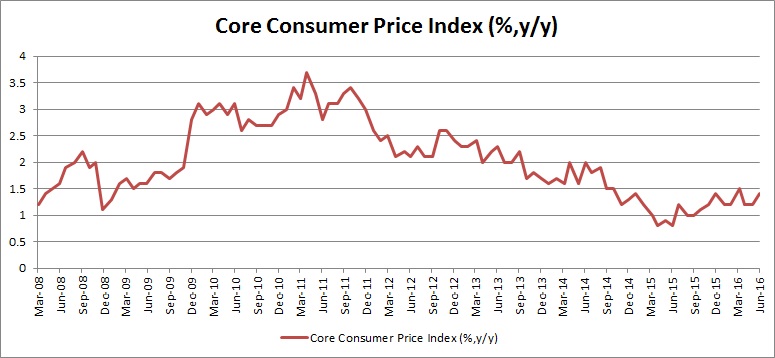

- Core consumer price index: After bottoming in June last year, core consumer prices (C-CPI) has crept higher, however, it has consistently failed to grow faster than 1.5 percent. However, there is a possibility that the downtrend that saw C-CPI growth decline from 3.6 percent in 2011 to below 1 percent in early last year is over.

- Producer price index (input): This should be closely watched today as the weaker pound is expected to hit this component the hardest and there could be a spike. Even the market is expecting 2 percent y/y growth in July, compared to -0.5 percent in June. It has been broadly in the negative territory since late 2013. In recent days, however, it has been creeping higher.

- Producer price index (output): As input costs declined over the last few years, producers have been passing the benefits to consumers to spark higher demand. Like other indices, it has also been creeping higher in recent days but the pace of reversal has been very weak so far.

- House price index: House prices have been soaring in the United Kingdom since the 2008/09 crisis. The price growth has somewhat slowed since the oil price crash but still strong. Other housing market indicators are suggesting that the house prices will drop in July and growth will slow down on a yearly basis.

- Retail price index: There could be a marked slowdown in RPI as the consumer sentiment deteriorated after the referendum.

The most vital would be to watch out the sterling’s and rate markets’ reaction to the data, especially whether the rate cut bets remain despite higher inflation or not. Sterling is currently trading at 1.292 against the dollar.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record