- Recent data suggest that the stock piling in the US has climbed to levels not seen in at least 80 years. As restriction remains over US oil exports, the stock piling is not expected to ease in months ahead.

- Producers have begun to cut down on rigs that so far have not contributed to a decline in total production. Recent rise in gasoline price seems to be more than a phenomenon of refiners' cut down in processing, than sharp come back of demand.

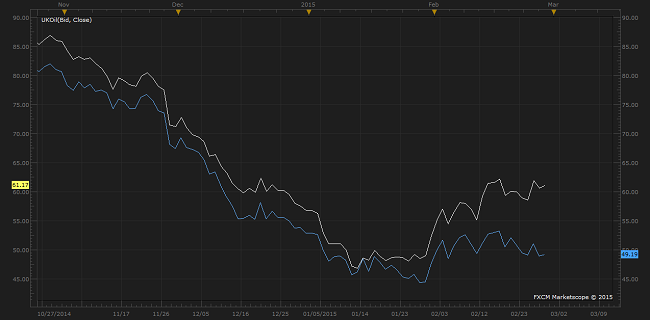

- Moreover as oil supply becomes an issue of USA, WTI oil spreads are declining steadily.

- Brent crude, a North Sea benchmark already enjoying a spread close to $12 rising from $1 a month ago, same can be seen in Ural, Siberian benchmark.

- Dollar appreciation against other currencies also adding up the pain of US companies, as other benchmark producers receive payments in dollars but cost remains in local currency.

WTI loss is expected to continue against other benchmarks, unless the fall in production is significant or US opens up to export.

In chart WTI is marked in blue & Brent in white.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings