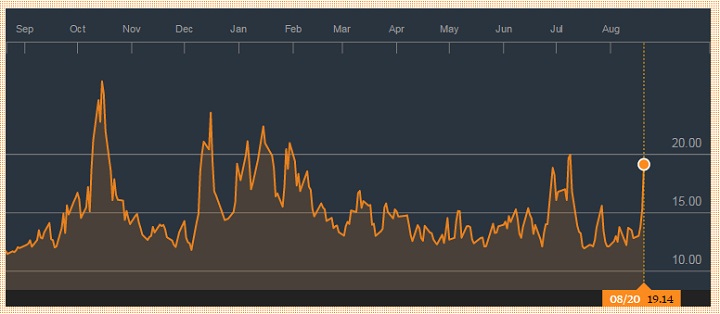

Chicago Board Options Exchange S&P volatility Index, known as VIX in short rose to highest since September rout in equity market. It used as fear gauge by market participants.

As of now it seems, it is unlikely to reverse immediately from here, since S&P 500 has cleared below key support area of 2040 last night. Moreover China which is at centre of recent turmoil, doesn't look like to recover any time soon.

Notably Chinese stock market declined by 11.5% this week.

VIX has risen almost 50% this week, its ninth largest weekly increase on record.

Which strategy to use as VIX rises?

- Momentum strategies are likely to do well with rising volatility, both in stock market as well as currency market.

- Safe haven assets are likely to enjoy, while VIX rises, such as Yen, Franc, Gold, Treasuries and German bund.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary