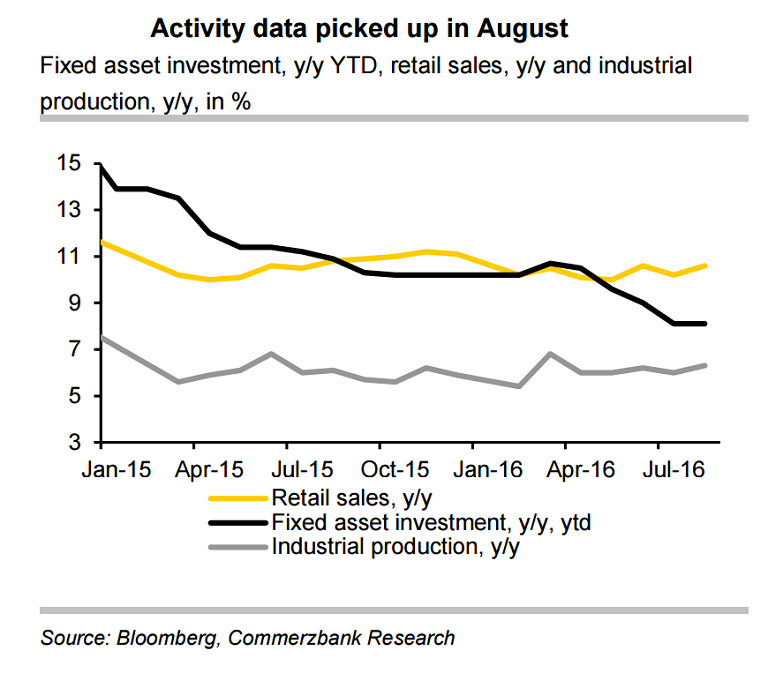

China's economy picked up steam in August, as demand rebounded on higher government spending and a year-long credit and property boom. China’s August activity data which came in stronger than expected, following a set of weak data points in July suggest that China’s economy is stabilizing.

Data released on Tuesday showed that China's industrial production and retail sales gained 6.3 percent y/y and 10.6 percent respectively in August, compared with 6.0 percent and 10.2 percent in July. Meanwhile, fixed asset investment grew 8.1 percent y/y year-to-date (YTD) in August, unchanged from last reading.

Details of the report showed that private investment remained at a new record low, gaining 2.1 percent y/y YTD in August, while the investment from state-owned enterprises remained strong at 21.4 percent y/y YTD. Increased spending in the public sectors reflects the government’s effort to stabilize the economy. Property investment rose 6.2 percent year-on-year, substantially above the 1.4 percent increase seen in July.

"Today’s data suggest that the downside risk of Q3 GDP has significantly reduced. Recent data, including the August PMI and August exports (+5.9% y/y), suggest that growth momentum has stabilised in Q3. If momentum holds up, China’s GDP could maintain a growth rate of 6.6-6.7% in Q3, from 6.7% in Q2." said ANZ in a report.

The rebound in today’s numbers is in line with that seen in recent data releases. China's official manufacturing PMI came in 50.4 in August, marking the fastest improvement in conditions since October 2014. Trade data for August also impressed, particularly for imports which grew in year-on-year terms for the first time in 22 months.

Amidst positive data, private investment remained at a new record low, gaining 2.1 percent y/y YTD in August, indicating that China’s economy still faces strong headwinds. That said, while economic activity in China has cooled this year, it now appears less at risk of a hard landing than feared in 2015. And with some stabilization seen in the Chinese economy, it seems the People's Bank of China (PBoC) has turned the focus to “risk control” for the time being.

In recent weeks, the PBoC has started to offer money via 14-day and 28-day reverse repos, while controlling the liquidity injection via 7-day reverse repos. This new tactics suggests that the central bank intends to contain the leverage ratio in bond trading activities. However, it will be also dangerous to conduct a rapid deleveraging in the bond market and Chinese authorities are likely to tread softly.

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?