The yen has sold off over the past month against a generally strong USD, although it has appreciated versus a weak euro. Disappointing domestic economic data, including a second successive quarterly fall in GDP in Q3, may have contributed to the yen's depreciation but the move primarily reflects the market's re-pricing of the likelihood of an early hike in interest rates by the US Fed.

Indeed, recent comments from the BoJ have indicated a reluctance to ease monetary policy further. The pace of QE expansion was left unchanged after the BoJ's late October policy meeting. Governor Kuroda in subsequent comments attributed the delay in meeting the inflation target to the low oil price and expressed confidence that economic conditions are improving. This suggests that the BoJ is in no hurry to ramp up further its monetary stimulus.

Indications that additional fiscal stimulus is to be introduced may have added to the BoJ's reluctance to consider further monetary loosening. Despite those comments, an expansion of QE is still a possibility in the first half of next year.

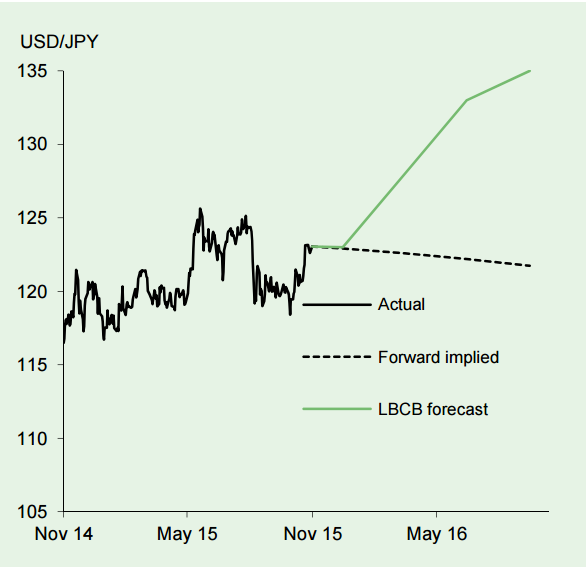

"We look for further weakening in yen to 135 before a likely subsequent recovery in late 2016 and into 2017", says Lloyds Bank.

USD/JPY Outlook

Tuesday, November 17, 2015 10:50 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed