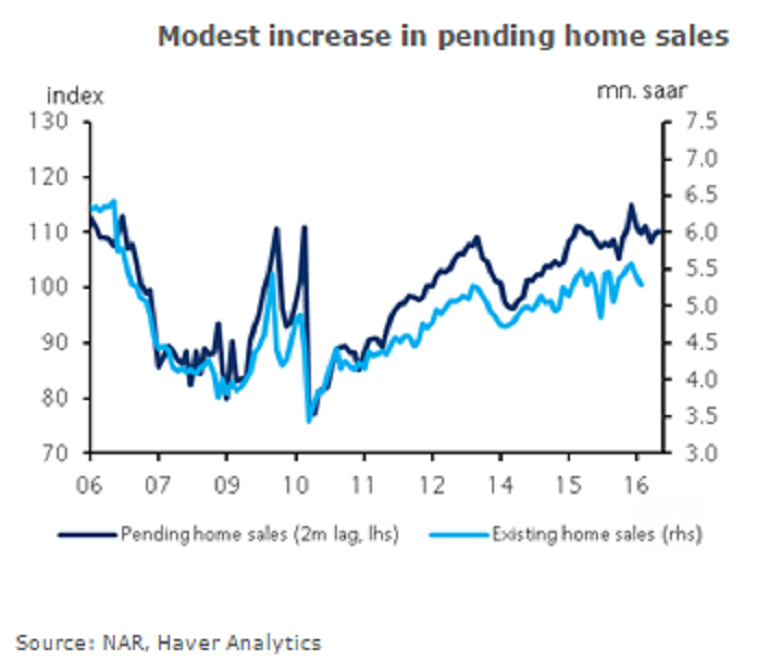

Pending home sales in the United States marginally rose during the month of October, showing off a steady improvement in the housing sector through this year and next. Also, a limited quantity of existing home inventories led to the mild rise in sales, despite a strong consumer-led residential properties demand.

US pending home sales rose 0.1 percent m/m in October, coming in line with consensus estimates. The September print was revised lower by one-tenth to 1.4 percent m/m. Sales increased in the Northeast, Midwest, and West on the month, data released by the National Association of Realtors (NAR) showed Wednesday.

However, sales declined 1.3 percent in the South, following solid growth the previous month. On the whole, today’s data are consistent with market view of steady improvement in the housing sector through this year and the next.

Further, there are underlying concerns surrounding the availability of houses in the market, raising eyebrows over a possible upward pressure on the prices. This year, 40 percent of sales were above list price compared with 33 percent last year, reports said.

Although worries remain regarding the overall health of the economy, guidelines remain to be framed post the Federal Reserve December monetary policy meeting and the new policy framework to be revealed by the President-elect Donald Trump.

Meanwhile, the dollar index has formed a bullish pattern at 101.43, down 0.09 percent at the time of closing, while at 5:00GMT, the FxWirePro's Hourly Dollar Strength Index remained neutral at -18.48 (a reading above +75 indicates bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions