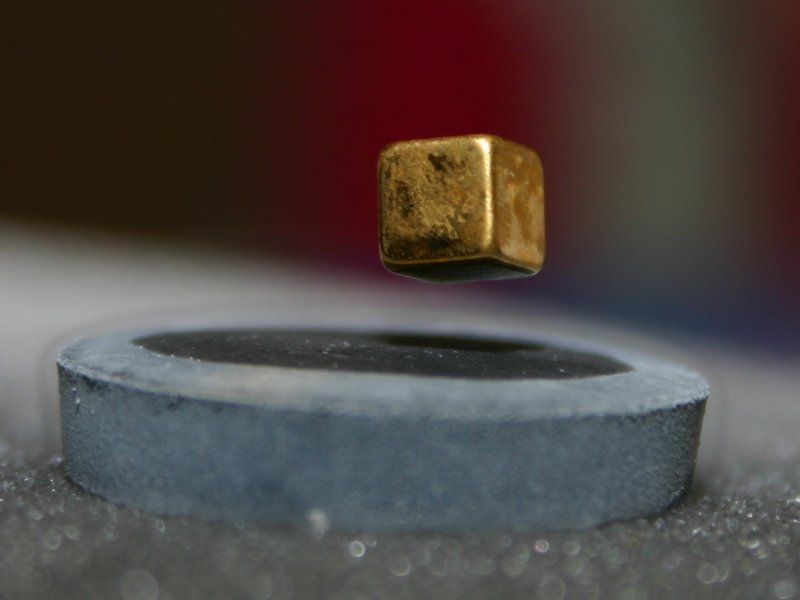

The U.S. is intensifying efforts to reduce China’s dominance in the rare earths market by introducing a separate pricing system backed by the Department of Defense (DoD). This move includes a deal with MP Materials, the sole U.S. rare earth miner, to guarantee a minimum price of $110/kg for neodymium and praseodymium (NdPr)—roughly double the current China-set price of $63/kg.

China controls about 90% of the global rare earth supply, making it difficult for Western companies to compete due to artificially low prices. These critical metals are essential for defense technologies, electric vehicles, and wind turbines. The new U.S. benchmark is expected to shift global pricing dynamics, boosting incentives for domestic production while potentially raising costs for automakers and end consumers.

MP Materials, based in Las Vegas, plans to begin commercial magnet production in Texas by year-end. Under the new deal, the DoD will acquire a 15% stake in the company, which aims to scale up output to 10,000 metric tons annually—meeting U.S. domestic magnet demand.

Consultancies like Adamas Intelligence and Project Blue note that the pricing move could benefit other players like Solvay and Aclara Resources. However, questions remain about whether industrial buyers will absorb the higher costs or diversify supply chains. Demand for rare earth magnets is forecast to more than double globally to 607,000 tons by 2035, with the U.S. expected to grow at 17% annually.

Despite past efforts, Western governments have struggled to weaken China’s grip on the market. This pricing floor represents a major shift in strategy, moving beyond tax incentives toward more direct intervention aimed at securing supply chain resilience for strategic materials.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue  U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages

U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy

Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains