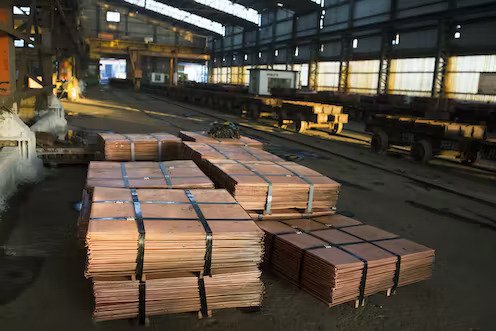

Potential U.S. tariffs on copper are unlikely to curb imports but could push domestic prices higher, benefiting American producers like Freeport-McMoRan. Since the U.S. election, the Comex-LME copper futures spread has widened, with the Comex premium averaging 5% (20 cents per pound) since November 2024 and reaching 7% (30 cents) in the spot market.

UBS argues that copper tariffs lack strong economic justification, as they would raise costs for consumers without significantly boosting U.S. mining or smelting investment. However, tariffs could sustain the Comex premium, favoring domestic refined copper producers. The U.S. imports 800,000 tonnes of refined copper annually—about half its consumption. While potential restarts of the 200,000-tonne Hayden smelter and expanded production at Rio Tinto’s Garfield facility may reduce reliance on imports, they won’t eliminate it.

Domestic copper supply growth faces permitting challenges rather than economic barriers, making it unlikely that tariffs would drive major mining investments. The U.S. remains a net exporter of copper concentrate and scrap while importing refined and semi-fabricated copper. Tariffs could shift scrap flows, increasing domestic processing but squeezing refining margins.

Despite short-term volatility from speculative trading, UBS remains bullish on copper due to limited mine supply growth and strong demand. Its top copper stock picks include Antofagasta PLC (LON:ANTO), Anglo American PLC (LON:AAL), and Freeport-McMoRan Copper & Gold Inc (NYSE:FCX).

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit