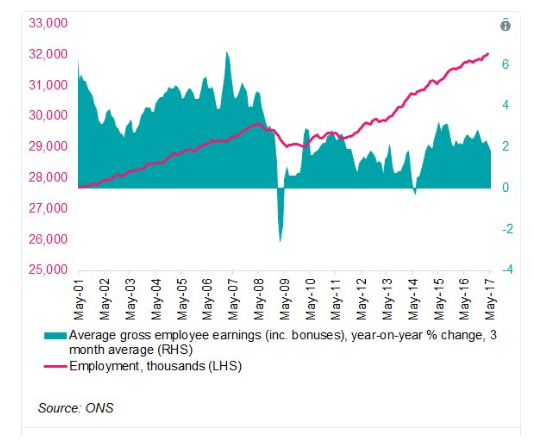

UK's already impressive unemployment rate took another dip in the three months to May, data from the Office for National Statistics showed on Wednesday. UK ILO jobless rate came in at 4.5 percent in three months to May versus 4.9 percent in the same period of previous year, beating expectations for a reading of 4.6 percent. This was the lowest since 1975. The British pound strengthened against other major currencies in the European session after employment data.

The number of unemployed decreased by 64,000 from previous three months to 1.49 million. The employment rate was 74.9 percent, the highest since comparable records began in 1971. Including bonus, average weekly earnings for employees increased by 1.8 percent on a yearly basis. Excluding bonus, earnings rose 2 percent compared with a year earlier. The claimant count rate remained unchanged at 2.3 percent in June.

Despite a surging jobs market, wages have failed to keep up the pace, with inflation eating into household earnings. Pay growth remains historically weak and below inflation. Real wages have seen an alarming slide, turned negative for the first time in over two years in 2017. This is the third month in a row that real earnings have fallen, raising fears over a slowdown in consumer spending.

Inflation is now above the Bank of England’s target level and real earnings growth has slipped into negative territory. Coupled with rising uncertainty over the Brexit negotiations, the BoE Monetary Policy Committee would need to see a distinct improvement in earnings growth to start raising interest rates.

“The data certainly fuel suspicions that the Bank of England will be in no hurry to raise interest rates; there’s a strong argument that hiking borrowing costs at a time of falling real pay and heightened uncertainty regarding the economic and political outlooks would merely introduce another headwind to an already-struggling economy," said Chris Williamson, Chief Business Economist, IHS Markit.

GBP/USD was trading 0.26 percent higher on the day at around 1.2877 at 1200 GMT. Immediate resistance is seen at 1.29 levels which is converged 5-DMA and cloud top. While 20-DMA at 1.2835 is strong support on the downside. Close below 20-DMA could see further drag. Technical indicators do not offer clear direction.

At 1200 GMT FxWirePro's Hourly GBP Spot Index was neutral at 15.3736 levels. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal