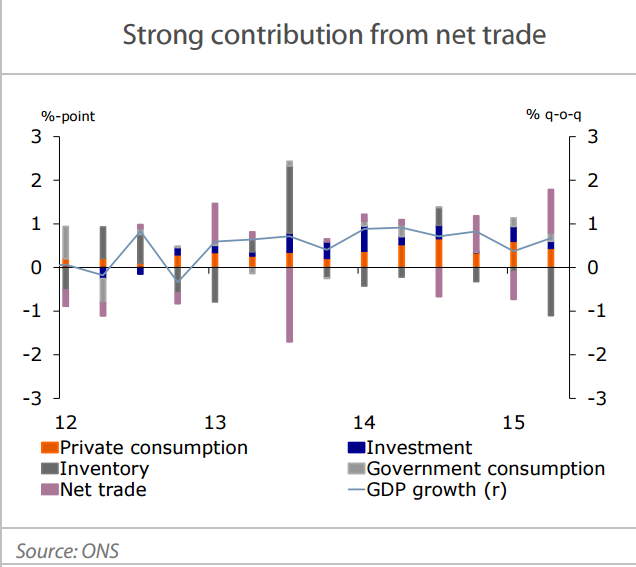

The second estimate of GDP in 2015Q2 confirmed that the British economy expanded by 0.7% q-o-q in the second quarter of 2015. All components, except inventory formation, contributed positively to economic growth. Private consumption increased by 0.7% q-o-q and investment by 0.9%. The latter was mainly driven by business investments, which increased by 2.9% q-o-q. Housing investment, on the other hand, shrunk by 3.5%. But most notable was the 3.9% q-o-q increase of exports. Since imports increased only 0.6% q-o-q, net trade contributed 1% to economic growth. However, this support is not expected to last, since British firms will likely suffer from the strong pound sterling compared to the euro, which will make British products relatively more expensive for the eurozone.

Furthermore, lower productivity growth over the last couple of years -compared to competitors in the United States and Europe- might hurt export performance going forward. On average, nominal wages increased by 2% over the last year, while labour productivity all but stagnated in 2014 (+0.1%). A strong decrease in export orders for July, according to the CBI survey, support the view of a slowdown in export growth in 2016.

UK economic growth in Q2 widely supported

Wednesday, September 2, 2015 10:48 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm