A Trump administration will present challenges to both Asian currencies and bonds. Trump’s pro-US growth and pro-fiscal stimulus economic policies coupled with a protectionist stance on global trade is a major setback particularly for trade-reliant countries like Singapore, Malaysia, Thailand, Taiwan and South Korea. Countries like Indonesia and India which are more domestically driven economies are likely to be less impacted.

Trump’s election proposals, which are pro-US growth supported by fiscal spending, will ultimately underpin the US economy, further boosting employment and wage growth. With U.S. labour market already close to full employment, it will push US inflation higher, meeting the US Federal Reserve’s dual mandate sooner than expected. Market pricing of a Fed rate hike at December meeting has risen to 80 percent after the elections and 36.8 percent of another 25bp hike by December 2017).

"We think there is a significant under-pricing of rate hikes beyond 2016. Our current house-view is for two 25bp hikes in 2017," said ANZ in a report to clients.

Asian region witnessed strong capital inflows of around USD39bn in the first nine months of the year on the back of the easy monetary policies of global central banks. The large portfolio flows into the region this year is at risk of a reversal as further monetary accommodation is now in doubt.

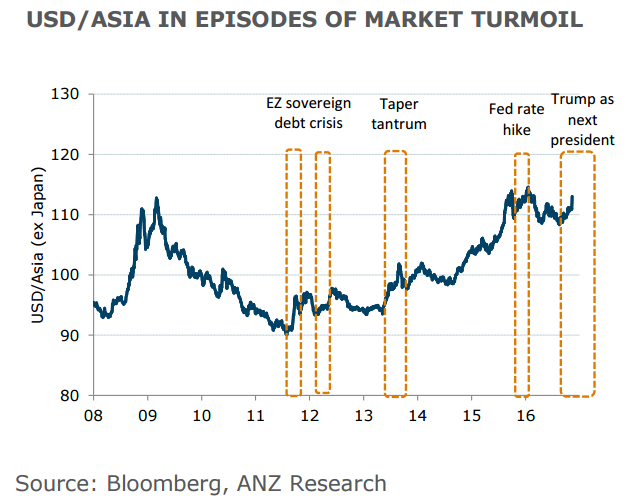

KRW and MYR are risk-sensitive currencies which are most vulnerable. RMB, together with the SGD is likely to lose further ground in trade-weighted terms. Asian bonds are also to come under pressure, extending the recent sell-off. Unlike in the previous episodes when Asian currencies rebounded swiftly after a short period of sell-off, the fall in Asian currencies this time round will most likely extend through 2017.

FxWirePro's Hourly Currency Strength Index was showing USD strength at +81.4924 at around 1245 GMT.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings