Thailand's annual headline inflation missed forecasts in March, coming in below the central bank's target range. Data released by the commerce ministry on Monday showed that Thailand's annual headline inflation rose 0.79 percent year-on-year in March, missing expectation for a rise of 0.90 percent in a Reuters’ poll. The rise compared to a 0.42 percent annual increase in the previous month. In the January-March period, the index rose 0.64 percent from a year earlier.

Details of the report showed the core CPI, which excludes raw food and energy prices, remained unchanged at 0.63 percent in March from a year earlier, in line with expectations. In January-March, the index was up 0.61 percent year-on-year. The decline in headline CPI was largely attributable to a 0.28 percent m/m drop in food prices and a slower-than-anticipated increase of 0.03 percent m/m in non-food prices.

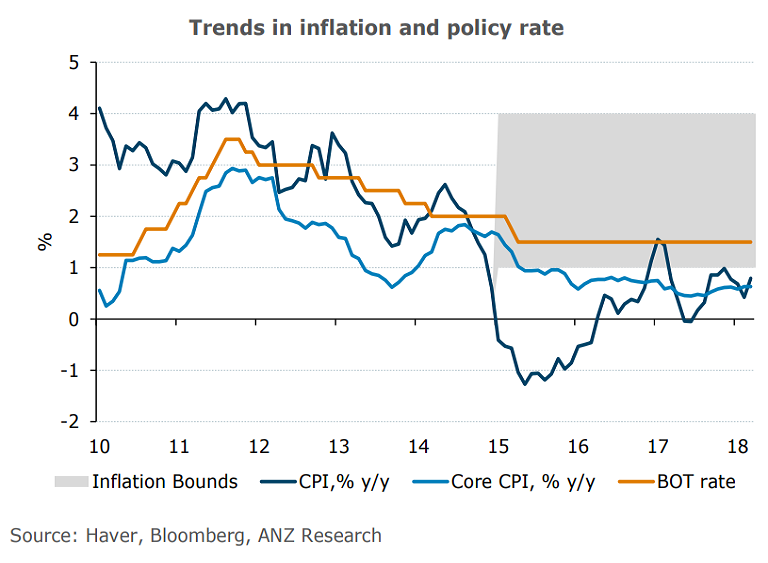

Thailand's headline inflation has remained below the lower bound of the official target range of 1-4 percent for the 13th consecutive month. Today's inflation data continues to point to very weak price pressures in the economy. Further, March PMI data for Thailand which was also released today showed a sharp fall in both input and output prices.

The Bank of Thailand (BoT) has left its policy interest rate steady at 1.50 percent, near record lows, since April 2015. The BoT has recently lowered its 2018 full year headline and core inflation forecast to 1.0 percent y/y and 0.7 percent y/y, from 1.1 percent y/y and 0.8 percent y/y respectively. The BoT will next review policy on May 16 and most analysts expect no policy change for the rest of 2018, though some predict rate increases in the second half of this year.

"We believe that inflation will rise only moderately this year – domestic demand is simply not sufficient to engender price pressures. Accordingly, we do not expect the BoT to change its accommodative monetary policy stance through 2018. There is ample leeway for the central bank to further nurture growth and allow inflation to move into its target band", said ANZ in a report.

USD/THB has been on a downward spiral since September 2015. The pair is extending decline from highs of 36.668 and is currently trading at 31.166. Technical indicators show no signs of reversal. Next bear target 30.876 (Sept 2013 low). Break below 30.876 finds next major support at 30.295 (78.6% Fib retrace of 28.560 to 36.668 rally).

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook