Tata Motors urges Indian authorities to resist reducing the 100% import tax on electric vehicles (EVs) to protect the domestic industry and its investors. This move comes as the government considers allowing Tesla's entry into the market.

According to Reuters, citing sources familiar with the matter, the plans are currently under review.

Tesla's Request for Lower Import Taxes for EVs Stirs Up Debate

As India strives to boost domestic manufacturing and encourage EV adoption, Tesla has proposed setting up a factory in the country, Business News pointed out. However, the company is calling for lower import taxes on electric cars.

This proposal is part of India's new policy to potentially reduce the import tax on EVs to at least 15% for companies committed to local manufacturing. Such a move could enable Tesla to establish its factory in India and produce its proposed $24,000 car while importing its higher-priced models with lower taxes.

Tata's Stand Against the Proposed Tax Changes

Tata, one of India's leading carmakers, has vehemently opposed the plan during meetings with Prime Minister Narendra Modi's office and other relevant departments. The company argues that its investors made decisions based on the assumption that the existing tax regime would remain unchanged in favor of domestic players.

Tata contends that more government support is needed in the early stages of the EV industry's growth to ensure the success and sustainability of local players.

Launched in 2019, Tata's EV business has received significant traction. Private equity firm TPG and Abu Dhabi state holding company ADQ have invested $1 billion in Tata's EV business, valuing it at approximately $9 billion. However, there are concerns that lower fees for foreign players could risk future fundraising efforts.

The EV Market in India and Tesla's Entrance

Although India's EV market is relatively tiny, Tata remains a dominant player, with 74% of the 72,000 electric cars sold this year manufactured by the company. With challenges in the increasingly competitive US market, Tesla has set its sights on India's automotive market, one of the largest worldwide, with over 3 million cars sold annually.

While the EV market share in India is still low, the Modi government actively encourages using clean vehicles, and the sector is experiencing rapid growth.

The domestic car industry in India has previously rallied against Tesla's attempts to reduce taxes. Tata Motors' executive expressed concerns that such a move would contradict the government's Make-in-India initiative. The industry successfully prevented the tax reduction proposed by Tesla in late 2021.

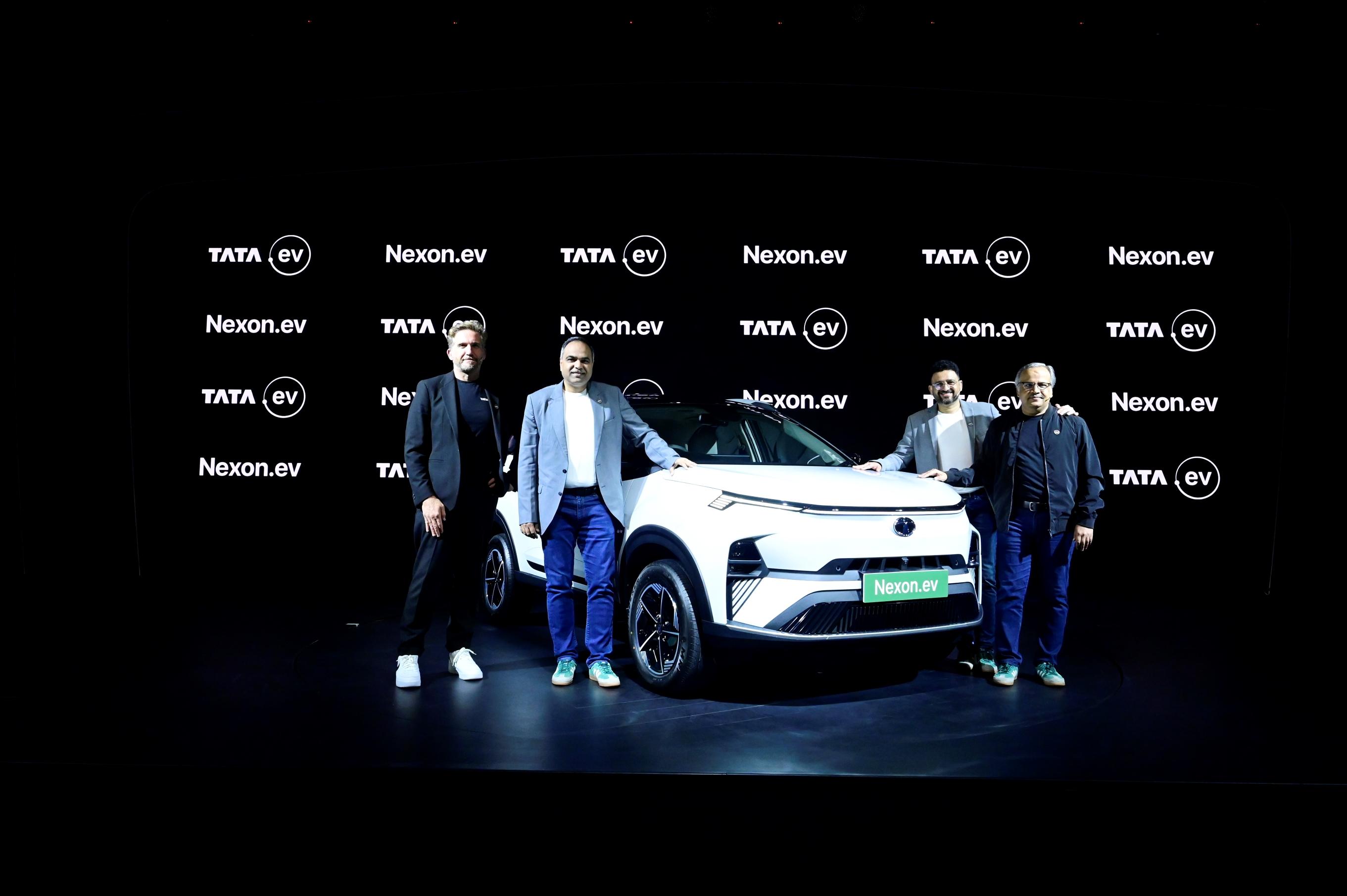

Photo: Tata Motors Pressroom

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links